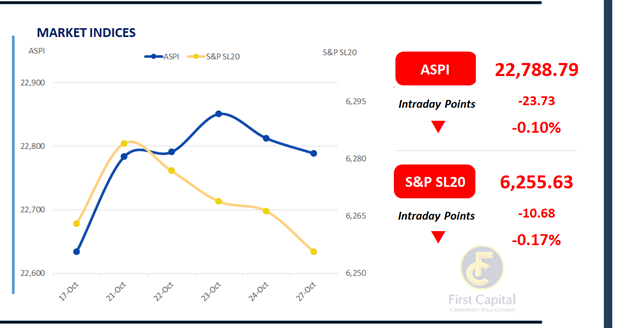

The Colombo Bourse extended its decline for a second consecutive session, with the ASPI easing by 24 points to close at 22,789. Despite an early uptick in the index, investor sentiment remained cautious, resulting in a subdued trading session.

Retail participation was moderate, while HNW interest was mainly focused on Banking and blue-chip counters. Key negative contributors to the index included CTHR, CFIN, RICH, SFCL, and BUKI.

Market turnover stood at LKR 5.8Bn, approximately 23% below the monthly average of LKR 7.5Bn. The Capital Goods sector led activity, accounting for 25% of total turnover, followed by the Banking and Health Care Equipment sectors, which collectively contributed another 27%. Meanwhile, foreign investors remained net buyers, posting a net inflow of LKR 176.6Mn for the day.

BOND MARKET

Yield curve stays static amid mixed investor sentiment

Moderate volumes and mixed investor sentiment marked the opening of the new week. Activity was predominantly visible in the short to mid segments of the yield curve.

However, the yield curve was seen remaining largely static by the end of today’s session. At the short end of the curve, 15.09.2027 traded at 9.00%. 2028 maturities attracted noteworthy activity with, 15.01.2028 and 15.03.2028 both trading at 9.20% and 15.02.2028 trading lower at 9.17% while 01.05.2028 and 01.09.2028 were seen changing hands at 9.25% and 9.30% respectively.

Moving ahead, 15.05.2030 and 01.07.2030 both traded at 9.78%. Finally, 01.07.2032 was seen trading at 10.80% while 01.10.2032 traded lower at 10.53%. On the external front, the LKR depreciated against the USD, closing at LKR 303.77/USD compared to LKR 303.61/USD seen previously. Overnight liquidity in the banking system expanded to LKR 135.06Bn from LKR 129.13Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..