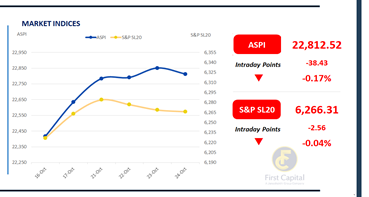

The Colombo Bourse witnessed mixed sentiment throughout the session, ultimately closing in negative territory as the ASPI declined by 38 points to settle at 22,813 amid heightened profit-taking.

Retail participation remained strong, while notable HNW interest was observed in blue-chip counters. Key negative contributors to the index included HARI, SAMP, MELS, SFCL, and CARG.

Market turnover amounted to LKR 6.2Bn, approximately 18% below the monthly average of LKR 7.5Bn. The Capital Goods sector dominated activity, accounting for 23% of total turnover, while the Diversified Financials and Banking sectors collectively contributed 31%. Meanwhile, foreign investors remained net buyers for the day, recording a modest net inflow of LKR 25.9Mn

BOND MARKET

Market momentum persists amid mixed sentiment

The secondary bond market sustained its positive momentum from the previous session, with investor sentiment remaining mixed and trading volumes holding at moderate levels.

Activity was concentrated across the short to mid segment of the curve, while the overall yield curve remained broadly unchanged. At the short end of the curve, the 15.01.2027, 01.05.2027, and 15.09.2027 maturities were seen trading at yields of 8.35%, 8.77%, and 8.89%, respectively.

Moving to the 2028 segment, the 15.02.2028 maturity transacted at 9.18%, the 15.03.2028 maturity at 9.20%, the 01.07.2028 maturity at 9.25%, and the 01.09.2028 maturity at 9.30%.

Further along the curve, the 15.09.2029 bond changed hands at 9.70%, while the 15.10.2029 bond traded at 9.72%. Among the 2030 maturities, the 15.05.2030 and 01.07.2030 issues traded at 9.76% and 9.78%, respectively.

Lastly, towards the mid end of the curve, the 15.03.2031 maturity changed hands at 10.10%. On the external front, the LKR depreciated against the USD, closing at LKR 303.61/USD compared to LKR 303.26/USD seen previously. Overnight liquidity in the banking system expanded to LKR 129.13Bn from LKR 123.3Bn recorded the previous day.

First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..