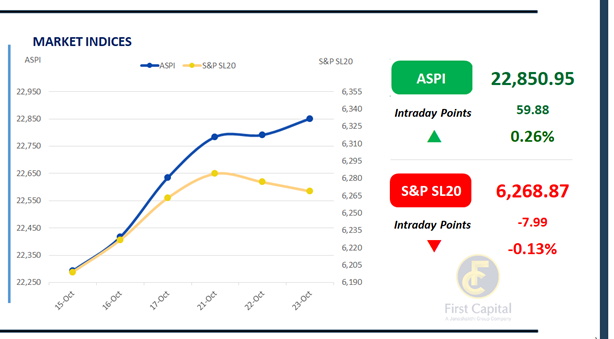

The Colombo Bourse extended its upward momentum, with the ASPI advancing by 60 points to close at 22,851. While retail participation remained moderate, strong HNW interest was evident, supported by notable off-board transactions in DFCC, LGL, and RCL.

Key positive contributors to the index included HAYL, GRAN, RICH, CARG, and BFL. Additionally, large-cap counters such as HNB, COMB, and JKH declined, exerting pressure on the S&P SL20 index.

Market turnover was high at LKR 9.2Bn, approximately 24% above the monthly average of LKR 7.5Bn. The Banking sector led market activity, accounting for 22% of total turnover, while the Capital Goods and Energy sectors collectively contributed 29%. Meanwhile, foreign investors turned net buyers, recording a modest net inflow of LKR 13.8Mn.

BOND MARKET

Trading volumes see major revival; investor sentiment stays mixed

Today marked a turnaround from the lethargic atmosphere that dominated the secondary market earlier in the week. Although investor sentiment remained mixed, trading activity gained momentum, ending the day with high overall volumes.

At the short end of the curve, 01.08.2026 and 15.12.2026 changed hands between 8.25% to 8.37%. In terms of 2028 maturities, 15.03.2028 traded at 9.22% while 01.05.2028 and 01.07.2028 traded between 9.23% and 9.27%. Moving ahead, 15.10.2029 traded at a rate of 9.72% and 15.05.2030 was seen changing hands between 9.75% to 9.80% while 01.07.2030 traded at 9.79%.

Further along the yield curve, 01.10.2032 was seen trading at a rate of 10.68% and finally, 01.11.2033 traded between 10.70% and 10.75%. On the external front, the LKR depreciated against the USD, closing at LKR 303.26/USD compared to LKR 303.11/USD seen previously. Overnight liquidity in the banking system expanded to LKR 123.3Bn from LKR 119.1Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..