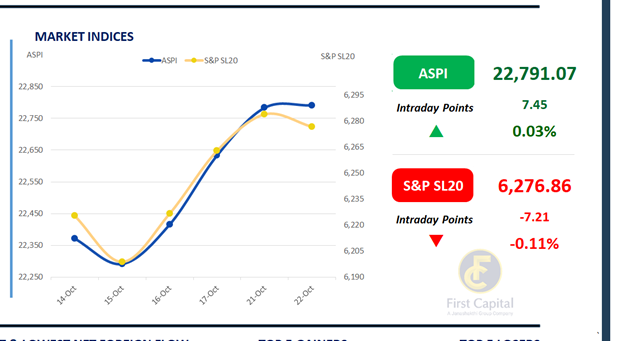

The Colombo Bourse witnessed mixed sentiment during the session but ultimately closed in positive territory, with the ASPI recording a marginal gain of 7 points to end at 22,791.

While HNW activity remained moderate, retail participation continued to be strong. DOCK, SAMP, CFIN, HARI, and HUNT were among the key positive contributors to the index.

Turnover stood relatively low at LKR 6.6Bn, approximately 12% below the monthly average of LKR 7.5Bn. The Capital Goods sector dominated activity, contributing 23% to total turnover, while the Banking and Diversified Financials sectors collectively accounted for 32%. Meanwhile, foreign investors remained net sellers, recording a net outflow of LKR 235.1Mn.

BOND MARKET

Subdued secondary market with controlled selling pressure

The secondary bond market maintained its subdued momentum today, characterized by low trading volumes and moderate selling being observed in the 2028 maturities.

Among the traded securities, at the short end of the curve, the 01.05.2027 maturity was transacted at a yield of 8.77%. Within the 2028 segment, the 15.02.2028 maturity traded at 9.20%, the 15.03.2028 at 9.25%, and the 15.12.2028 maturity at 9.33%.

The CBSL conducted its weekly T-Bill auction today, where a total of LKR 39.6Bn was accepted, despite total bids reaching LKR 108.6Bn. The amount raised also fell short of the initially offered LKR 70.0Bn. A sum of LKR 4.5Bn was accepted for the 3-month maturity, LKR 30.8Bn for the 6-month maturity, and LKR 4.4Bn for the 12-month maturity.

The weighted average yields across all three tenors remained unchanged. On the external front, the LKR depreciated against the USD, closing at LKR 303.1/USD compared to LKR 303.0/USD seen previously. Overnight liquidity in the banking system contracted slightly to LKR 119.1Bn from LKR 120.1Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..