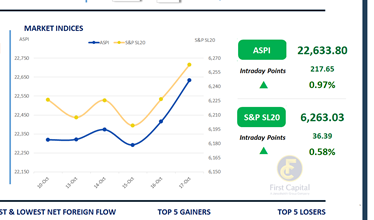

The Colombo Bourse maintained its upward momentum throughout the day, gaining 218 points to close at 22,634. The market witnessed a higher number of off-board transactions, while HNW activity remained strong, particularly in Banking and other blue-chip counters.

Retail participation was average compared to previous sessions, with limited interest seen in small to mid-cap shares. CTHR, HARI, CARG, JKH, and DFCC emerged as the key positive contributors to the index.

Turnover remained robust at LKR 11.3Bn, marking a significant 57% increase compared to the monthly average of LKR 7.2Bn. A share volume of 779,123 in HARI accounting for a notable stake of 40% was purchased by HAYL, contributing significantly to today’s turnover.

The Banking sector dominated activity, accounting for 29% of total turnover, while the Food, Beverage, and Diversified Financials sectors collectively contributed 38%. Meanwhile, foreign investors remained net sellers, recording a net outflow of LKR 1.4Bn.

BONDMARKET

Yield curve stays static as the week draws to a close

While the secondary market appeared to have emerged from yesterday’s slump, the week came to an end on a rather lukewarm footing.

Investor sentiment appeared mixed while market volumes were somewhat moderate as the yield curve remained static. Amongst the noteworthy trades that took place today, 15.12.2029 was seen trading between 9.68% to 9.70% while 01.07.2032 changed hands between 10.80% to 10.85%.

Finally, the 01.11.2033 maturity was also seen trading at a rate of 10.72%. On the external front, the LKR depreciated marginally against the USD, closing at LKR 302.99/USD compared to LKR 302.97/USD seen previously. Overnight liquidity in the banking system expanded slightly to LKR 143.54Bn from LKR 140.38Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..