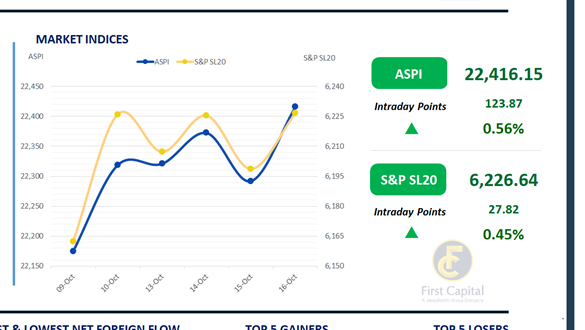

The Colombo Bourse gained 124 points today to ultimately close at 22,416. Retail participation in small to mid-cap shares was lower compared to previous sessions, while HNW activity was strong in blue-chip counters.

HHL, SAMP, VLL, RICH, and DIMO emerged as the key positive contributors to the index. Turnover remained robust at LKR 8.9Bn, marking a 27% increase compared to the monthly average of LKR 7.0Bn, primarily driven by a LKR 1.2Bn crossing on HHL.

The Banking sector led turnover, contributing 28%, while the Capital Goods and Diversified Financials sectors collectively accounted for 40%. Meanwhile, foreign investors remained net sellers, recording a net outflow of LKR 1.4Bn.

BOND MARKET

Secondary market drifts through a quiet session amid thin volumes

The secondary bond market witnessed a notably subdued trading session today, characterized by exceptionally low activity levels and limited investor participation.

Market sentiment remained largely muted, with overall trading volumes staying thin, leaving the yield curve unchanged. Activity was primarily confined to a handful of transactions, with maturities in the 2027 segment changing hands within a yield range of 8.73% to 8.83%.

Further along the curve, the 01.07.2030 maturity was seen trading at 9.80%. On the external front, the LKR depreciated against the USD, closing at LKR 302.97/USD compared to LKR 302.73/USD seen previously. Overnight liquidity in the banking system contracted further to LKR 140.38Bn from LKR 156.38Bn recorded the previous day.

Courthesy:First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..