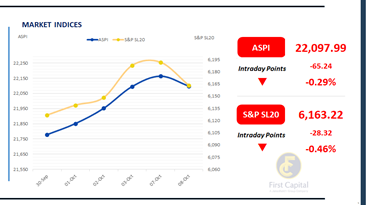

Post hitting the 22,000 milestone on ASPI, today marked the first day of profit taking, after 15 consecutive days of gains. While both retail and HNW participation was high, investors have largely realized gains on the Banking sector counters and conglomerates.

Accordingly, the ASPI closed the day at 22,098, losing 65 points. BUKI, SUN, DIAL, COMB and CARS were the top contributors to the index. Turnover stood at LKR 7.3Bn, reflecting an increase of 5% compared to the monthly average that stands at around LKR 7.0Bn.

Banking sector took the lead in terms of sector wise contributions to turnover, with a share of 21%, followed by Capital Goods sector and Food retailing sector, which produced a combined contribution of 35%.

Food retailing sector’s high turnover was underpinned by the increased HNW participation observed in CARG and CTHR. Foreign investors remained net sellers, recording a net outflow of LKR 196.2Mn.

BOND MARKET

Market remains subdued as volumes stay thin

The secondary bond market withstood a quiet session marked by thin volumes whilst sentiment remained dull. Notable transactions during the day were concentrated towards 2029 maturities, while the yield curve remained unchanged.

Trades executed during the day included maturities dated 15.09.2029, 15.10.2029, and 15.12.2029, which traded within a narrow range of 9.72% to 9.74%. The CBSL conducted its weekly T-Bill auction today, where a sum of LKR 19.1Bn was accepted, despite total bids reaching LKR 53.2Bn.

The amount raised also fell short of the initially offered LKR 33.5Bn. For the 3-month maturity, LKR 5.4Bn was accepted with the weighted average yield declining by 1bp to 7.52%. The 6-month bill saw an uptake of LKR 9.1Bn, while the 12-month maturity recorded LKR 4.5Bn.

Weighted average yields for the 6-month and 12-month bills remained unchanged at 7.89% and 8.02%, respectively. On the external front, the LKR depreciated against the USD, closing at LKR 302.49/USD vs. LKR 302.48/USD seen previously. Overnight liquidity in the banking system expanded to LKR 174.3Bn from LKR 152.2Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..