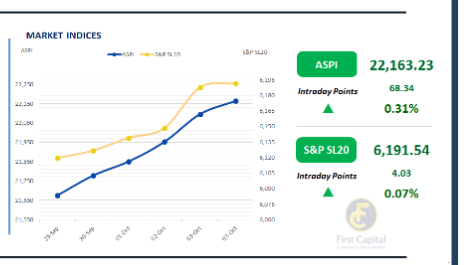

Continuing the bullish leap of the previous week, the Colombo Stock Exchange demonstrated an upward momentum, driven by rising investor optimism.

Banking sector counters, coupled with blue-chip companies exerted a positive pressure on the ASPI, which closed the day at 22,163, after registering a gain of 68 points.

LION, SPEN, MELS, BREW and SAMP were the top positive contributors to the index. While both retail and HNW participation remained elevated during the day, turnover stood at LKR 8.0Bn, reflecting an increase of 16% compared to the monthly average that stands at around LKR 6.9Bn.

Banking sector took the lead in terms of sector wise contributions to turnover, with a share of 24%, followed by Capital Goods sector and Diversified Financials sector, which produced a combined contribution of 27%. Foreign investors remained net sellers, recording a net outflow of LKR 223.3Mn.

BOND MARKET

Mixed sentiment marks start of week in secondary market

The secondary bond market opened the week on a mixed note, marked by selling pressure in the 2029 maturities alongside buying interest in longer-term tenors.

However, overall trading volumes remained subdued throughout the day. Among the trades executed during the day, the 15.10.2028 maturity, transacted at a yield of 9.25%. Within the 2029 segment, the 15.06.2029 bond traded at 9.70%, while the 15.10.2029 and 15.12.2029 maturities were executed at yields of 9.72%.

In contrast, activity in the longer-dated segment reflected buying interest, with the 15.09.2034 and 15.06.2035 maturities trading at 10.82% and 10.90%, respectively. On the external front, the LKR appreciated against the USD, closing at LKR 302.48/USD vs. LKR 302.52 seen previously. Overnight liquidity in the banking system slightly contracted to LKR 152.2Bn from LKR 172.4Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..