Riding the wave of yesterday's bullish surge, the Colombo Bourse charged ahead once more, fueled by a powerful rally in Capital Goods and Blue-chip counters.

In the early hours of trading, the market experienced a volatile session marked by notable selling pressure. But the market refused to back down.

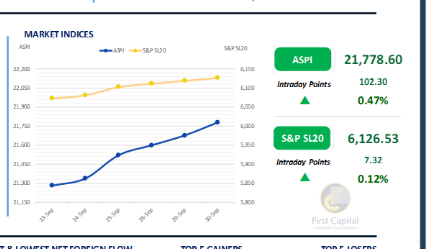

In a steady and determined climb, it fought its way back, turning red into green. By the closing bell, the index stood at 21,779, a resounding gain of 102 points, sealing another victorious chapter in its upward march.

Participation from HNW investors remained relatively low with moderate participation from retail investors. Additionally, top positive contributors to the index included, DIMO, BUKI, CCS, MELS and WATA.

Turnover for the day stood at LKR 6.3Bn, reflecting a decrease of 12% compared to the monthly average that stands at around LKR 7.1Bn.

Food, Beverage & Tobacco sector took the lead in terms of sector wise contributions to turnover, with a share of 20%, followed by the Consumer services and the Capital Goods sectors which produced a combined contribution of 28%. Foreign investors remained net sellers, recording a net outflow of 362.2Mn

BOND MARKET

Sentiment remains mixed while volumes stay thin

The secondary market endured yet another day of thin volumes and limited activity while investor sentiment remained largely mixed.

At the short end of the curve 15.03.2028 and 01.05.2028 traded between 9.05% to 9.10%. In terms of 2029 maturities, 15.06.2029, 15.09.2029 and 15.12.2029 were seen changing hands between 9.48% to 9.60%.

Moving ahead, 01.07.2032 traded at 10.65% while 01.10.2032 traded marginally lower at 10.40%. Finally, at the long end of the curve, 15.09.2034 traded at a rate of 10.80%.

On the external front, the LKR depreciated marginally against the USD, closing at LKR 302.61/USD compared to LKR 302.60/USD recorded the previous day. Overnight liquidity in the banking system expanded to LKR 198.8Bn from LKR 170.9Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..