The Colombo Bourse kicked off the week on a positive note, marked by a wave of bullish sentiment.

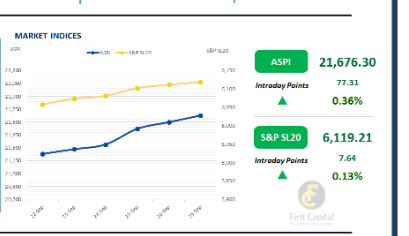

The ASPI posted a gain of 77 points and closed at 21,676, strengthened by plantation sector counters and conglomerates.

CARS, MELS, JKH, NAMU and WATA were the top positive contributors to the index. Moderate retail participation was chiefly observed on plantation sector counters, whereas HNW participation was lower during the session.

Turnover for the day stood at LKR 4.3Bn, reflecting a decrease of 41% compared to the monthly average that stands at around LKR 7.2Bn.

Food, beverage & Tobacco sector took the lead with a share of 26%, while Diversified Financials sector and Capital Goods sector jointly contributed to 31% of the total turnover.

Additionally, buying sentiment towards Banking sector has been lowered. Foreign investors remained net sellers, recording a net outflow of LKR 15.6Mn.

BOND MARKET

Dull market sentiment leads to quiet week start

Following last week's mixed sentiment, the secondary market yield curve experienced low activity and volumes, with market sentiment turning subdued at the start of the week.

As a result, there was no change in the yield curve. The number of trades in the market was minimal, with the 15.01.2028 bond trading at a rate of 9.00%, and the 01.07.2030 maturity trading between the rates pf 9.70% and 9.71%.

On the external front, the LKR depreciated marginally against the USD, closing at LKR 302.6/USD compared to LKR 302.5/USD recorded the previous day.

Overnight liquidity in the banking system expanded to LKR 170.9Bn from LKR 150.0Bn recorded the previous day. Furthermore, the average weighted prime lending rate (AWPR) for the week ending 26 -Sep-2025 declined by 2bps to 8.05%, compared to the previous week.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..