The Colombo Bourse wrapped up the week on a high note, continuing the positive trend from last week. Today's positive momentum was largely fueled by the strong performance observed in conglomerates.

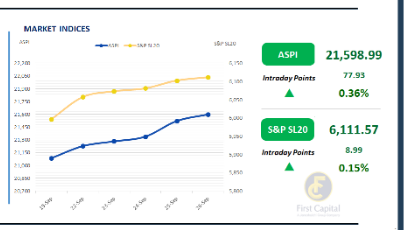

The ASPI posted a gain of 78 points and closed at 21,599. DIAL, HHL, GRAN, SUN and KCAB were the top positive contributors to the index. Both retail and HNW participation remained relatively average during the session.

Turnover for the day registered LKR 6.0Bn, reflecting a decrease of 16% compared to the monthly average that stands at around LKR 7.1Bn. Capital Goods sector took the lead with a share of 22%, while Banking sector and Food, Beverage & Tobacco sector jointly contributed to 36% of the total turnover.

Additionally, more positive investor sentiment was observed towards Plantation sector counters. Foreign investors remained net sellers, recording a net outflow of LKR 155.0Mn.

BOND MARKET

Selling pressure at the short end pushes yields higher

The secondary market yield curve saw moderate trading volumes and mixed activity, with some selling pressure observed at the short end.

As a result, yields at the shorter end of the curve edged higher. Among the traded maturities, the 01.08.2026 and 01.05.2027 bonds were traded at yields of 8.20% and 8.70%, respectively.

The 15.01.2028, 15.02.2028, and 15.03.2028 bond maturities were traded within a range of 8.95% to 9.02%, while the 01.05.2028, 01.07.2028, 15.10.2028 and 15.12.2028 bonds changed hands at the yields between 9.10% and 9.16%.

Further along the curve, the 01.07.2030 maturity traded in the range of 9.70% to 9.72%, whereas the 01.10.2032 and 15.12.2032 changed hands between the rates 10.40% to 10.45%.

Additionally, the 01.11.2033 and 15.09.2034 bonds were traded at yields of 10.75% and 10.80%, respectively. On the external front, the LKR appreciated against the USD, closing at LKR 302.5/USD compared to LKR 302.6/USD recorded the previous day. Overnight liquidity in the banking system expanded to LKR 150.0Bn from LKR 132.7Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..