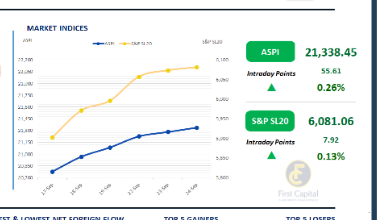

After a volatile trading session, the Colombo bourse closed on a higher note, with ASPI marking a gain of 56 points and closing at 21,338.

Although the early trading hours saw profit taking pressure, a late recovery helped pare early losses. CINS, LFIN, HAYL, CFIN and COMB were the top positive contributors to the index.

Both retail and HNW participation were neutral, which could have possibly been due to CBSL's decision to maintain the current Overnight Policy Rate.

Turnover for the day reached LKR 5.6Bn, reflecting a decrease of 21% compared to the monthly average that stands at around LKR 7.0Bn. Capital Goods sector took the lead with a share of 27%, followed by a combined contribution of 29% from Diversified Financials sector and Banking sector. Foreign investors turned net sellers, recording a net outflow of LKR 118.3Mn.

BOD MARKET

Secondary market activity picks up following policy announcement

The secondary market experienced mixed sentiment whilst overall activity picked up relative to previous sessions, although volumes remained moderate.

This came in the wake of the Monetary Policy Board's decision to keep the OPR unchanged at 7.75%, citing alignment with the 5% inflation target amid domestic and global conditions.

Amongst the trades seen today, 01.05.2026 and 01.08.2026 bonds were seen trading within 8.15%-8.20%, whilst the 15.01.2027 maturity traded at 8.30%, followed by the 01.05.2027 maturity which traded within the 8.60%-8.65% range.

Within the 2028 segment, the 15.02.2028 and 15.03.2028 bonds traded at the narrow range of 8.93%-8.95%. Moving along the curve, the 01.07.2030 maturity traded at 10.71%, whilst the 01.10.2032 maturity traded between 10.40%-10.41% and the 15.12.2032 maturity traded between 10.35%-10.45%.

Finally, the 01.06.2033 bond changed hands at 10.73%. The CBSL's weekly T-Bill auction took place today where a sum of LKR 34.4Bn was accepted, despite total bids reaching LKR 69.3Bn.

The amount raised also fell short of the initially offered LKR 38.0Bn. For the 3-month maturity, LKR 3.2Bn was accepted; the 6-month bill saw the largest uptake with LKR 29.1Bn, while the 12-month maturity recorded LKR 1.9Bn.

Weighted average yields across all three tenors remained unchanged. On the external front, the LKR depreciated against the USD, closing at LKR 302.53/USD compared to LKR 302.41/USD recorded the previous day. Overnight liquidity in the banking system slightly expanded to LKR 136.6Bn from LKR 135.4Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..