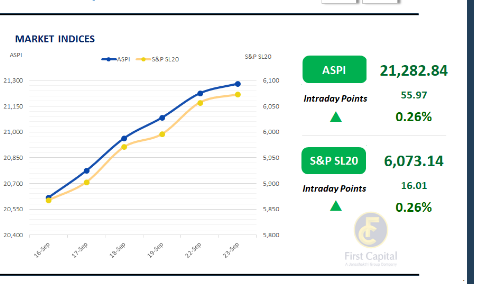

The Colombo bourse retained its bullish tone, as the buying pressure persisted during today's session. ASPI marked a gain of 56 points and closed at 21,283.

Although the ASPI ended on a green note, the number of negative contributors to the index outpaced the number of positive contributors. HAYL, LOLC, BIL, DIMO and CCS were the top positive contributors to the index.

Both retail and HNW participation was high, while more positive sentiment was observed towards NBFI sector counters and specific Hotel sector counters. Turnover for the day reached LKR 6.6Bn, reflecting a decrease of 7% compared to the monthly average that stands at around LKR 7.0Bn.

Remarkably, Diversified Financials sector took the lead with a share of 22%, followed by a combined contribution of 37% from Banking sector and Capital Goods sector. Foreign investors remained net buyers, recording a net inflow of LKR 61.4Mn.

BOND MARKET

Trading softens ahead of policy update

The secondary market navigated a lackluster session, weighed down by thin volumes and mixed investor sentiment. Market participants appear to have adopted a measured stance owing to the impending monetary policy decision set to be announced early tomorrow.

Amongst the few noteworthy trades seen today, 01.10.2032 was seen trading 10.40% while 15.12.2032 changed hands at 10.45%. Further ahead on the yield curve, 15.09.2034 traded at 10.80% and finally, 15.06.2035 traded at 10.85%.

On the external front, the LKR depreciated marginally against the USD, closing at LKR 302.41/USD compared to LKR 302.37/USD recorded the previous day. Overnight liquidity in the banking system contracted to LKR 135.4Bn from LKR 140.8Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..