The Colombo Bourse opened the week on a positive note, extending the bullish momentum carried over from the end of last week.

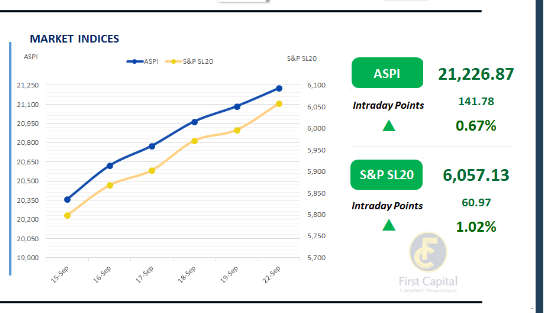

ASPI marked a gain of 142 points and closed at 21,227 by the end of the session. Moreover, the session stood out with robust investor activity and above-average turnover.

JKH, CTHR, SFCL, COMB and VONE were the top positive contributors to the index. Both retail and HNW participation drove today's rally, while HNW participation was mainly observed towards Construction sector and larger Hotel sector counters.

Positive investor sentiment towards the Construction sector could have possibly been driven by the country's economic expansion by 4.9% in 2Q25.

Turnover for the day reached LKR 8.1Bn, reflecting an increase of 8% compared to the monthly average that stands at around LKR 7.5Bn.

In terms of sector-wise contribution to turnover, the Capital Goods sector took the lead with a share of 45%, followed by the combined contribution of 28% from Banking sector and Diversified Financials sector.

Foreign investors remained net buyers, recording a net inflow of LKR 584.1Mn.

BOND MARKET

Tepid trading keeps the yield curve stable as the week begins

The secondary bond market saw thin trading volumes, leading to a stable yield curve as activity remained subdued. Among the traded maturities, the bonds maturing on 01.05.2028 and 15.12.2028 exchanged hands at rates of 9.00% and 9.05%, respectively.

Further along the yield curve, the 15.06.2029, 15.09.2029, and 15.12.2029 maturities traded at 9.40%, 9.48%, and 9.50%, respectively.

Meanwhile, 01.07.2030, 15.12.2032, 01.11.2033, and 15.06.2035 were traded at rates of 9.70%, 10.44%, 10.67%, and 10.86%, respectively.

On the external front, the LKR depreciated marginally against the USD, closing at LKR 302.4/USD compared to LKR 302.1/USD recorded the previous day.

Overnight liquidity in the banking system expanded to LKR 140.8Bn from LKR 126.8Bn recorded the previous day. Additionally, for the week ending 19-Sep-2025, the Average Weighted Prime Rate (AWPR) declined by 6bps to 8.07%.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..