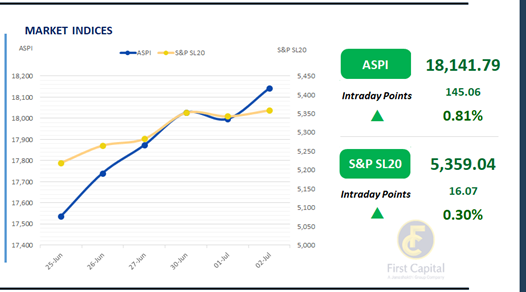

The market experienced a rebound in investor sentiment, leading to a recovery from the previous session. The ASPI closed in positive territory, re-entering the 18,000 zone with a gain of 145 points, ending the day at 18,142.

The session opened with strong upward momentum, which was largely sustained throughout the day, although some volatility emerged toward the close. CTHR, DOCK, AEL, RIL and JKH were among the top positive contributors to the index.

Retail and HNW investor participation remained strong throughout the session. Turnover for the day stood elevated at LKR 7.8Bn, representing a 55% increase from the monthly average of LKR 5.0Bn.

The Capital Goods sector was the top contributor to today’s turnover, accounting for a share of 28%. This was followed by the Banking, and Diversified Financials sectors which produced a joint contribution of around 30%. Foreign investors remained net sellers, with a net outflow of LKR 224.0Mn.

T-Bill auction yields flat, buying sentiment rebounds

Reversing the cautious sentiment from the previous day, the secondary market sustained buying interest in the 2028 and 2029 maturities, while renewed buying interest emerged in the 2031 and 2033 maturities.

As a result, both volumes and overall activity reached moderate levels. Amongst the traded maturities, 15.03.2028, 01.05.2028, 01.07.2028 and 15.10.2028 were seen changing hands between 8.70% to 8.80%. Moving ahead on the yield curve, the 15.06.2029, 15.10.2029 and 15.12.2029 maturities traded at the range of 9.42% to 9.32%.

Additionally, 15.03.2031 maturity traded at the rate of 9.95%, whilst 01.11.2033 changed hands between the rates of 10.65% to 10.58%. Today, the Central Bank held its weekly T-Bill auction, raising LKR 113.0Bn, in line with the initially offered amount.

The 3M bill raised LKR 12.4Bn, falling behind its initial offer of LKR 25.0Bn, with the yield steady at 7.55%. The 6M bill raised LKR 42.0Bn, with its yield rising slightly by 3bps to 7.78%.

The 12M bill raised LKR 58.5Bn, higher than the initial offer, while its yield remained unchanged at 7.94%. In the forex market, the LKR depreciated against the greenback, closing at LKR 300.02/USD, compared to the previously seen rate of 299.95/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 99.4Bn from the previously seen level of LKR 110.8Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..