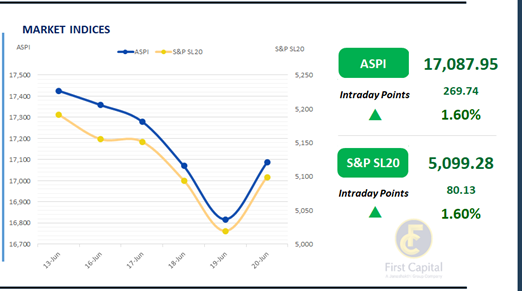

The Colombo Bourse concluded trading for the week on an upbeat note as positive sentiment led to a broader market recovery.

The ASPI experienced some volatility within the day but ultimately registered a gain of 270 points to close at 17,088. CINS, SAMP, HAYL, HNB and COMB emerged as the top counters that positively contributed to the index.

Retail and HNW investors engaged in moderate trading with interest primarily towards Banking sector counters. Turnover stood at LKR 2.5Bn, marking a 51% decrease compared to the monthly average of LKR 5.1Bn.

The Banking sector led today's turnover, contributing 28%, followed by the Diversified Financials, and Capital Goods sectors, jointly accounting for 24%. Foreign investors turned net sellers, with a net outflow of LKR 42.3Mn.

BOND MARKET

Selling hits 2028 maturities

Continuing the selling momentum from the previous day, market participants maintained a bearish stance amid ongoing global uncertainty.

The selling pressure was primarily concentrated on 2028 maturities, with limited trading activity observed overall.

Among the few traded maturities, the 15.02.2028, 15.03.2028, 01.07.2028, and 15.12.2028 maturities changed hands at yields ranging between 8.95% and 9.05%.

Further along the yield curve, the 15.06.2029 and 15.09.2034 maturities were traded at yields of 9.55% and 10.60%, respectively. In the forex market, the LKR appreciated marginally against the greenback, closing at LKR 300.65/USD, compared to the previously seen rate of 300.71/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 89.15Bn from LKR 115.13Bn in the previous session. In May 2025, Sri Lanka’s Manufacturing PMI registered a value of 55.5, signaling an expansion in manufacturing activity.

Meanwhile, the Services PMI stood at 57.0, reflecting a continued, though slightly slower, expansion in the services sector.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..