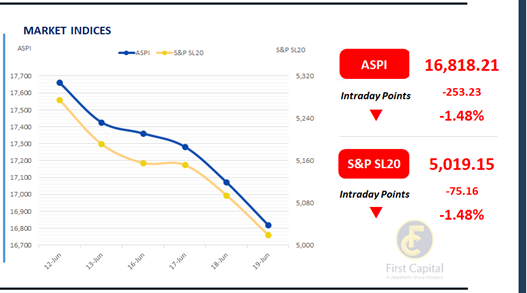

Negative sentiment continued to dominate the Colombo Bourse, carrying over into today’s session amid subdued investor activity, which resulted in lower volumes and turnover.

The ASPI experienced a steady decline, closing at 16,818 which reflects a drop of 253 points. This depicts the first time in two weeks that the index has fallen below the 17,000 mark.

Key negative contributors to the index included LOLC, JKH, CTC, NDB, and COMB. Retail investors engaged in moderate selling, while HNW investor participation remained subdued.

Turnover stood at LKR 3.3Bn, marking a 36% decrease compared to the monthly average of LKR 5.2Bn. The Banking sector led today's turnover, contributing 26%, followed by the Capital Goods, and Diversified Financials sectors, jointly accounting for 33%. Foreign investors remained net buyers, with a net inflow of LKR 77.7Mn

BOND MARKET

Mild selling surfaces amid prevailing uncertainty

The secondary market remained largely subdued today, reflecting the persistent cloud of geopolitical uncertainty. Still, amid the low volumes and restrained activity, a hint of selling managed to break through the stillness.

On the short end of the curve, 15.06.2029, 15.09.2029 and 15.12.2029 traded between 9.50% to 9.65%. Moving ahead on the yield curve, 15.12.2032 was seen changing hands at 10.40%.

Finally, 15.09.2034 and 15.03.2035 were seen trading within the 10.55% to 10.60% range. In the forex market, the LKR appreciated marginally against the greenback, closing at LKR 300.7/USD, compared to the previously seen rate of 300.8/USD.

Meanwhile, overnight liquidity in the banking system expanded to LKR 115.1Bn from LKR 101.1Bn in the previous session. Moreover, according to the latest data published by CBSL, credit to the private sector for Apr-25 stood at LKR 8,501.6Bn denoting a 15.2% YoY expansion.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..