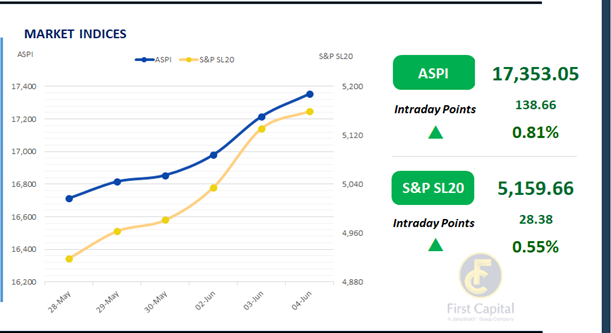

The Colombo Stock Exchange extended its winning streak, with the All Share Price Index (ASPI) climbing 139 points to close at a new all-time high of 17,353—marking its second consecutive record close.

The session saw notable intraday volatility: the market opened strong, dipped mid-day, and rebounded to end firmly in positive territory. Gains were driven by strong performances in CTC, CFIN, HHL, LION, and CARG.

Investor sentiment remained broadly optimistic, bolstered by increased retail participation. High-net-worth interest was particularly prominent in CDB and LOLC.

Turnover surged to LKR 7.4 billion—up 69% from the monthly average of LKR 4.4 billion. The Diversified Financials sector led activity, contributing 26% of total turnover, followed by the Capital Goods and Banking sectors, which together accounted for an additional 37%.

Despite the bullish domestic tone, foreign investors continued to trim exposure, posting a net outflow of LKR 71.4 million—highlighting persistent caution amid global market uncertainties.

BOND MARKET

Measured optimism returns as buying resumes

Today market participants deviated from the mixed stance that prevailed earlier in the week and displayed a measured appetite for buying amid moderate trading volumes.

Consequently, on the short end of the curve, 15.09.2027 and 01.05.2027 traded between 8.40% to 8.62%. Moving ahead, 2028 maturities were seen changing hands within the 8.75% to 8.95% range. Finally,15.06.2029, 15.09.2029 and 15.12.2029 were seen trading between 9.40% to 9.56%.

Today, the Central Bank of Sri Lanka conducted its weekly Treasury bill auction, successfully raising the full initial offer of LKR 167.5Bn.

The average weighted yield on the 3-month T-Bill held steady at 7.55%, while yields on the 6-month and 12-month tenors edged down by 4 basis points, settling at 7.73% and 7.94%, respectively.

In the forex market, the LKR appreciated marginally against the greenback, closing at LKR 299.5/USD, compared to the previously seen rate of 299.6/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 163.1Bn from LKR 156.7Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..