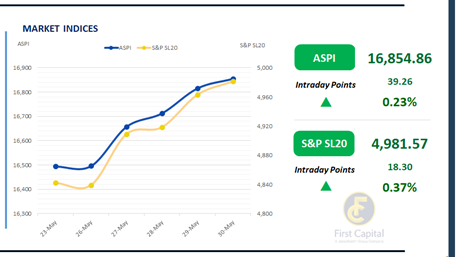

The Colombo Stock Exchange closed the week on a positive trajectory, with the ASPI gaining 39 points to settle at 16,855.

After a modest uptick at the open followed by a brief dip, the index rebounded and maintained upward momentum to close firmly in the green.

The rally was largely supported by notable gains in HAYL, CALH, which commenced trading today, COMB, NDB, and RIL. Investor sentiment remained upbeat, with heightened activity from retail participants, while HNW interest was observed particularly in LIOC, PKME and CALH.

Total market turnover reached LKR 5.2Bn, marking a 30% increase over the monthly average of LKR 4.0Bn. The Diversified Financials sector led turnover, accounting for 27% of the total, followed by the Banks and Capital Goods sectors, which collectively contributed 34%. Foreign investors continued to remain cautious, recording a net outflow of LKR 441.6Mn.

Bond market mood shifts, profit taking kicks in

As the week came to a close, the secondary bond market witnessed a reversal of the buying trend that was evident earlier in the week. The buying stance was replaced by profit taking, which in turn pushed the yield curve higher across the board.

Additionally, volumes in the secondary market were quite moderate today. On the short end of the yield curve, 15.01.2028, 15.02.2028, 01.05.2028 and 01.07.2028 traded between 8.60% to 8.90%.

In terms of the 2029 maturities, 15.06.2029, 15.09.2029 and 15.12.2029 were seen trading within the 9.35% to 9.60% range. Moving ahead on the yield curve, the 15.05.2030 maturity traded at 9.60%.

Finally, 15.12.2032 changed hands at 10.10% while 15.09.2034 traded at 10.40%. In the forex market, the LKR appreciated against the greenback, closing at LKR 299.4/USD, compared to the previously seen rate of 299.7/USD.

Meanwhile, overnight liquidity in the banking system contracted marginally to LKR 203.8Bn from LKR 207.9Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..