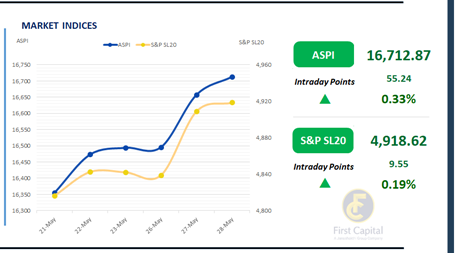

The Colombo Stock Exchange continued its upward trajectory, with the ASPI gaining 55 points to close at 16,713. While the index initially saw a modest pullback during early trading, a mid-session recovery helped it regain momentum and end firmly in positive territory.

The upward move was driven by strong performances from HHL, COMB, SPEN, DIAL, and SAMP, which were the day’s top contributors.

Investor sentiment remained broadly positive, supported by active participation from both HNW and retail investors. Interest from HNW investors was particularly evident in DIAL and HHL.

Market turnover amounted to LKR 4.3Bn, marking a 14% increase over the monthly average of LKR 3.8Bn. The Capital Goods sector led the market in terms of turnover with a contribution of 26%, while the Banking, and Food, Beverage & Tobacco sectors collectively accounted for 32%. However, foreign investors remained cautious, registering a net outflow of LKR 162.7Mn.

Auction yields dip, yield curve holds steady

After the Overnight Policy Rate cut, CBSL held its first weekly T-Bill auction today, fully raising the offered LKR 162.5Bn.

Notably, weighted average yield rates came across the board with 3M T-Bill falling by 10bps and the 6M and 12M bills falling by 20bps and 31bps, respectively.

Accordingly, the weighted average yields for 3M, 6M and 12M T-Bills stood at 7.55%, 7.77% and 7.98%, respectively. The secondary market witnessed mixed activity today, with yields on short- to mid-tenor maturities declining, while mid- to long-tenor yields remained broadly unchanged, resulting in high market volumes.

Accordingly, the 01.05.2028 and 01.07.2028 maturities traded at the rate of 9.00% whilst 15.10.2028 and 15.06.2029 traded at the rates of 9.07% and 9.50%, respectively.

Furthermore, 15.09.2029, 15.12.2029 and 15.05.2030 changed hands at the rates of 9.52%, 9.55% and 9.65%, respectively.

Additionally, 15.03.2031 and 15.12.2032 traded at the rates of 9.90% and 10.20%. In the forex market, the LKR depreciated marginally against the greenback, closing at LKR 299.7/USD, compared to the previously seen rate of 299.6/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 196.1Bn from LKR 203.2Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..