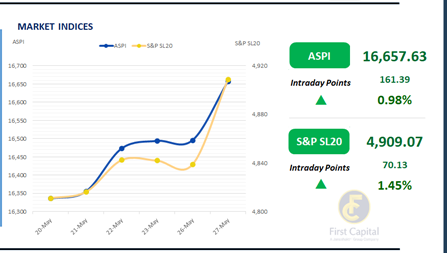

The Colombo Stock Exchange closed on a positive note, with the ASPI gaining 161 points to end the day at 16,658. The index saw a sharp rise during early trading, experienced a brief dip, and regained momentum to finish firmly in the green.

HNB emerged as the top contributor to the day’s performance, followed by MELS, CTHR, CARG, and COMB. Investor sentiment remained strong, fueled largely by heightened participation from HNW individuals.

Interest from HNW investors was particularly prominent in HNB and other Banking sector counters. Market turnover surged to LKR 18.7Bn, well above the monthly average of LKR 2.9Bn, primarily driven by the divestment of a 9.99% stake in HNB by BIL through nine off-board transactions totaling to 45.9Mn shares at LKR 305.0.

The Banking sector dominated trading, accounting for 81% of total turnover, while the Capital Goods, and Food, Beverage & Tobacco sectors collectively contributed 10%. Foreign investors remained net buyers recording a net foreign inflow of LKR 203.8Mn.

Buying interest persists as yield curve tapers down further

Secondary market participants maintained buying interest ahead of tomorrow’s T-Bill auction, leading to a further tapering down of the yield curve. Notably, buying interest was predominantly centered on 2028, 2029, 2030 and 20231 maturities.

Trading volumes and activity remained at moderate levels. As a result, 2028 maturities traded in the range of 9.20% to 9.00%, while 2029 and 2030 maturities changed hands in the ranges of 9.80% to 9.60% and 9.75% to 9.70%, respectively.

Meanwhile, 2031 maturities traded at a yield of 10.00%. In the forex market, the LKR depreciated marginally against the greenback, closing at LKR 299.6/USD, compared to the previously seen rate of 299.3/USD.

Meanwhile, overnight liquidity in the banking system further expanded to LKR 203.2Bn from LKR 192.2Bn in the previous session. Additionally, the Weekly Average Weighted Prime Lending Rate for the week ending 23rd May 2025 declined by 11bps to 8.47%, compared to the previous week.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..