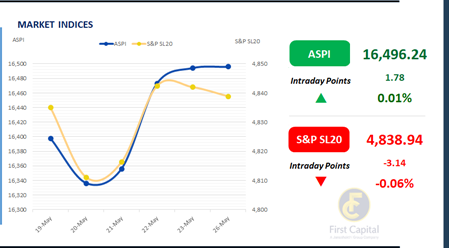

The Colombo Stock Exchange closed the day with a marginal gain of 2 points, with the ASPI settling at 16,496. The index experienced a sharp uptick during early trading hours, followed by a gradual decline throughout the session, before seeing a modest recovery to finish virtually unchanged from the previous session.

Key contributors to the day's performance included CCS, HHL, HAYL, DIAL, and BIL. Investor activity remained strong, driven by both HNW and retail participation.

HNW interest was particularly notable in major conglomerates such as HHL, HAYL, and DIAL. Market turnover reached LKR 3.8Bn, marking a 40% increase compared to the monthly average of LKR 2.7Bn.

The Food, Beverage & Tobacco sector dominated market activity, contributing 24% of the day’s turnover. The Capital Goods, and Telecommunication Services sectors followed, collectively accounting for 36%. Foreign investors remained net buyers recording a net foreign inflow of LKR 70.1Mn.

Secondary market opens strong with active buying

The secondary market began the week with a sustained buying sentiment, echoing the momentum seen in previous sessions. Market participants remained actively engaged, driving increased trading volumes.

On the short end of the curve, 15.02.2028, 15.03.2028, 01.07.2028 and 15.10.2028 traded within the 9.50%-9.25% range. Moving ahead on the yield curve, 15.06.2029, 15.09.2029 and 15.12.2029 traded between 10.00% to 9.85% while the 15.05.2030 maturity traded within the 10.10%-10.00% range.

Meanwhile, 15.03.2031 changed hands between the rates of 10.45% to 10.30% while 15.12.2032 was seen trading at 10.50%. CBSL has announced an upcoming T-Bond auction scheduled for 29th May-25, through which it aims to raise a total of LKR 200.0Bn.

The funds will be secured across three maturities: 2028, 2029, and 2034. Specifically, LKR 40.00Bn will be raised through the 2028 maturity, offering a coupon rate of 9.00%.

Meanwhile, the 2029 and 2034 maturities will each raise LKR 80.0Bn, with coupon rates set at 11.00% and 10.25%, respectively. In the forex market, the LKR appreciated marginally against the greenback, closing at LKR 299.3/USD, compared to the previously seen rate of 299.4/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 192.2Bn from LKR 157.8Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..