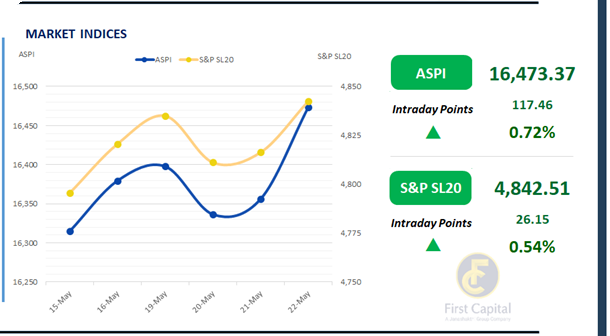

The Colombo Stock Exchange extended its upward momentum, with the ASPI gaining 117 points to close at 16,473. The rally followed the CBSL’s announcement of an Overnight Policy Rate reduction, which buoyed investor sentiment and led to a steady upward trajectory throughout the session.

Key contributors to the index’s performance included CARG, MELS, JKH, DIAL, and HHL. HNW and retail investors remained active, with notable HNW interest directed toward Banking sector counters.

Market turnover surged to LKR 4.5Bn, marking an 85% increase over the monthly average of LKR 2.5Bn. The Capital Goods sector led activity, accounting for 26% of total turnover, followed by the Diversified Financials and Food, Beverage & Tobacco sectors, which collectively contributed 30%.

Foreign investor participation also showed strength, with a net inflow of LKR 313.4Mn, signaling sustained interest in select equities amid improving macroeconomic signals.

Policy easing flattens the yield curve across the board

The Central Bank of Sri Lanka, at its meeting held on 21st May 2025, decided to reduce the Overnight Policy Rate by 25bps to 7.75%. The CBSL stated that; “this measured easing of monetary policy stance will support steering inflation towards the target of 5%, amidst global uncertainties and current subdued inflationary pressures”.

Following the monetary policy announcement, participants in the secondary market responded positively, with buying interest emerging in the market. As a result, the yield curve declined by an average of c.10bps across the board. Consequently, amongst the traded maturities, the 15.02.2028, 15.03.2028 and 01.07.2028 maturities traded in the rates of 9.57% to 9.75% while, 15.10.2028 and 15.12.2028 traded between the rates of 9.72% to 9.80%.

Further ahead of the curve, 15.06.2029, 15.09.2029, and 15.12.2029 traded between the rates of 10.05% to 10.15%. Finally, going ahead of the curve, the 15.03.2031, 01.10.2032 and 01.11.2033 maturities were seen changing hands at the rates of 10.55% to 10.85%. In the forex market, the LKR appreciated against the greenback, closing at LKR 299.8/USD, compared to the previously seen rate of 300.6/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 173.7Bn from LKR 163.2Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..