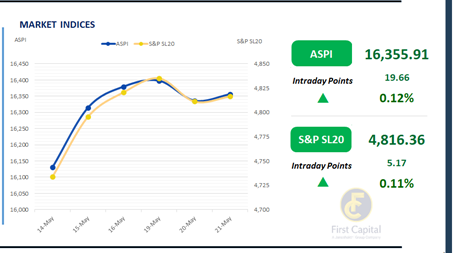

The Colombo Stock Exchange rebounded from the previous day's decline, with the ASPI gaining 20 points to close at 16,356. The index experienced early gains before retreating sharply mid-session, followed by a recovery that saw it end the day in positive territory

.

Key positive contributors included CARG, DIAL, CFLB, LLUB, and CTHR. Market turnover rose to LKR 2.4Bn, aligning closely with the monthly average. The Capital Goods sector dominated trading activity, accounting for 27% of total turnover, while the Banking, and Diversified Financials sectors collectively contributed 30%. Notably, foreign investors recorded a net inflow of LKR 510.4Mn, indicating continued interest in select equities.

Yield curve holds steady in pre-policy calm

Today activity in the secondary bond market appeared somewhat dormant as the market participants embraced a cautious approach ahead of CBSL’s 3rd monetary policy decision set to be announced tomorrow.

Consequently, the yield curve appeared largely unchanged amid the market’s wait and see approach. Among the few trades that took place, the 01.05.2028 maturity traded at 9.75% while further ahead on the yield curve, the 15.03.2031 maturity traded at 10.75%.

Finally, the 01.11.2033 maturity was seen changing hands at the rate of 10.97%. The CBSL held its weekly T-Bill auction today, fully raising the offered LKR 157.5Bn. The 3M T-Bill weighted average yield remained unchanged at 7.65%, with LKR 13.0Bn raised versus an offer of LKR 20.0Bn.

Weighted average yields on the 6M and 12M maturities edged down 1bps to 7.97% and 8.29%, respectively. The 6M T-Bill raised LKR 50.0Bn, matching its offer, while LKR 94.5Bn was accepted for the 12M Bill, exceeding its LKR 87.5Bn target.

In the forex market, the LKR depreciated against the greenback, closing at LKR 300.6/USD, compared to the previously seen rate of 299.5/USD. Meanwhile, overnight liquidity in the banking system contracted to LKR 163.2Bn from LKR 174.1Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..