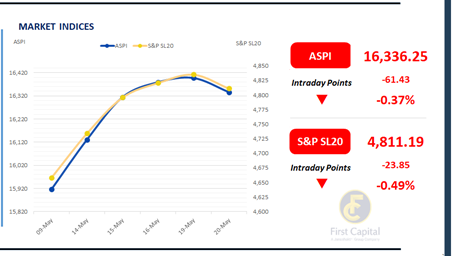

The Colombo Bourse closed in the red, with the ASPI down 61 points to 16,336. After a brief uptick early in the session, the index declined sharply, weighed down by price declines in Banking sector counters HNB and SAMP, and conglomerates JKH and SPEN.

While HNW investors showed selective interest in Banking stocks and JKH, overall market activity remained subdued during today’s session.

Turnover decreased to LKR 1.5Bn, 37.9% below the monthly average of LKR 2.4Bn. The Banking sector led activity with 23%, followed by Capital Goods and Diversified Financials, which together contributed 39%. Foreign investors recorded a net inflow of LKR 169.9Mn.

Yield curve remains stable amidst measured activity

The secondary bond market continued to reflect a mixed sentiment among participants during today’s trading session, echoing the mixed sentiment observed yesterday.

Trading volumes remained moderate, while the yield curve remained broadly unchanged. At the short end of the curve, the 15.02.2028 and 15.03.2028 maturities were actively quoted within the range of 9.65% to 9.60%.

Meanwhile, towards the belly end of the curve, 15.06.2029 and 15.12.2029 maturities changed hands between 10.20% and 10.15%.

Further along the curve, the 15.03.2031 maturity was seen trading at 10.70%. Notably, the 01.11.2033 maturity attracted foreign interest, trading at the rate of 10.95%, signalling selective appetite in the longer end of the curve.

In the forex market, the LKR depreciated against the greenback, closing at LKR 299.5/USD, compared to the previously seen rate of 298.8/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 174.1Bn from LKR 157.9Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..