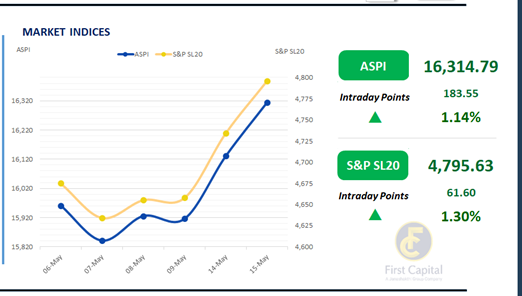

The Bourse extended its bullish momentum from yesterday, as investors engaged in an active trading session driven by sustained optimism. The ASPI registered a 1.14% gain, marked by a climb of 184 points, to close at 16,315

.

MELS, SAMP, COMB, SPEN and HAYL were the key positive contributors to the index. Retail and HNW investors demonstrated active trading, showcasing positive sentiment, primarily towards Banking sector and blue-chip counters.

Turnover reached LKR 4.6Bn, marking a significant increase of 120.1% compared to the monthly average of LKR 2.1Bn. The Banking sector led today's turnover, contributing 21%, driven by positive earnings reported in recent quarterly results.

The Capital Goods, and Diversified Financials sectors were next in line, jointly accounting for 36% of overall turnover. Foreign investors turned net sellers, with a net outflow of LKR 96.8Mn.

Bond market buying spree persists as yield curve softens

Continuing the previous day’s trend, bond market participants maintained a buying stance, leading to moderate volumes and activity.

Notably, demand was concentrated in the 2028 and 2029 bond maturities, which became the focal point of investor interest. Consequently, the yield curve eased across the board.

Additionally, CBSL advanced its third monetary policy review for the year, rescheduling it from 28th May 2025 to 22nd May 2025.

Amongst the traded maturities, 15.02.2028, 15.03.2028 and 01.07.2028 maturities traded at the rates of 9.67%, 9.70% and 9.75%, respectively whilst both 15.10.2028 and 15.12.2028 traded at the rate of 9.85%.

Meanwhile 15.06.2029, traded at the rate of 10.13% and both 15.09.2029 and 15.12.2029 bond maturities traded at the rate of 10.15%.

Additionally, 15.03.2031 maturity changed hands at the rate of 10.65% whilst 15.12.2032 traded at the rate of 10.75%. In the forex market, the LKR continued to appreciate against the greenback, closing at LKR 298.7/USD, compared to the previous day’s rate of 298.9/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 123.8Bn from LKR 183.1Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..