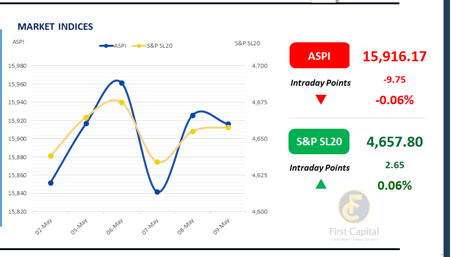

The Colombo Stock Exchange ended the session flat, with the ASPI falling marginally by 10 points to close at 15,916. Despite an early uptick, the index faced a sharp intraday decline, followed by volatile movements, ultimately closing marginally in the red.

Downward pressure on the index was primarily driven by losses in key counters including CARG, HHL, TJL, SPEN, and RCL. Sector-wise, trading activity was dominated by the Materials sector, which accounted for 21% of total turnover.

The Food, Beverage & Tobacco and Capital Goods sectors collectively contributed 32% to overall activity. Total market turnover amounted to LKR 1.5Bn, marking a 34.5% drop from the monthly average of LKR 2.4Bn, indicating a subdued trading session. Meanwhile, foreign participation turned positive, with net inflows totalling LKR 0.9Mn.

Muted morning trading gives way to post-auction activity

Today the secondary market remained rather dormant during the early hours of trading, however activity picked up following the T-Bond auction.

Post-auction activity saw buying interest particularly for the 2029 and 2031 maturities. However, overall trading volumes were moderate. The T-Bond auction held today came to a close with the initially offered amount of LKR 35.0Bn being raised through the 2029 maturity, for which the weighted average yield stood at 10.22%. Likewise, LKR 45.0Bn was raised via the 2033 maturity, for which the weighted average yield stood at 10.97%.

Prior to today’s T-Bond auction, the 01.07.2028 maturity traded at 9.85% while the 15.10.2028 and 15.12.2028 maturities traded at 9.90% and 9.95% respectively. Following the conclusion of the T-Bond auction, the 15.06.2029 maturity traded at 10.15%, 15.09.2029 at 10.18% and 15.12.2029 at 10.25%.

Moving further ahead on the yield curve, the 15.03.2031 maturity traded at 10.65% and finally the 01.11.2033 maturity traded at 10.88%. In the forex market, the LKR appreciated against the greenback, ending the day at LKR 299.3/USD, in comparison to yesterday’s LKR 299.5/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 194.5Bn from LKR 163.4Bn seen in the previous session

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..