The Colombo Stock Exchange closed lower following local government election results that signaled political uncertainty, with no clear majority for the ruling party.

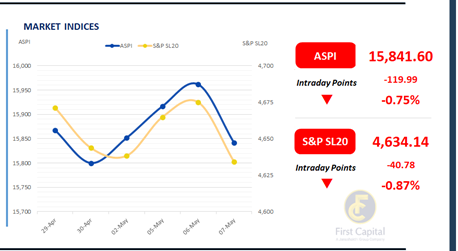

The ASPI fell 120 points to close at 15,842, after a volatile session that saw early losses, a brief recovery, and a subsequent decline. Major drags on the index included JKH, CINS, COMB, SPEN, and SAMP.

Investor sentiment remained concentrated in the Food, Beverage & Tobacco sector, which accounted for 61% of total turnover, reflecting heightened interest despite the broader market weakness.

The Capital Goods and Banking sectors followed, jointly contributing 18%. Total turnover reached LKR 3.2Bn, up 24% from the monthly average of LKR 2.6Bn. Foreign investors remained net sellers, recording a net foreign outflow of LKR 67.3Mn.

Post-election rally drives buying in the secondary bond market

CBSL conducted its weekly T-Bill auction today, raising LKR 122.7Bn, lower than the initially offered amount of LKR 130.0Bn. The weighted average yields for the 3M and 12M maturities remained unchanged at 7.65% and 8.30% respectively, compared to the previous auction, whilst the 6M T-Bill saw a marginal 1bps increase to 7.98%.

Following the election, market participants in the secondary market maintained a buying stance, driven by notable trading activity despite moderate volumes. Consequently, the yield curve remained mostly stable.

Amongst the traded maturities, at the short end, the 15.01.2027 maturity traded at the rates of 8.85% to 8.75%, while the 15.02.2028, 15.03.2028, 01.05.2028 and 01.07.2028 maturities traded at the rates of 9.84% to 9.70%, whilst 01.09.2028, 15.10.2028 and 15.12.2028 traded between the rates of 9.95% to 9.85%.

Meanwhile, towards the mid end, 15.07.2029, 15.09.2029 and 15.12.2029 changed hands between 10.38% to 10.20%. Additionally, 15.03.2031 and 01.10.2032 maturities traded at the rates of 10.75% to 10.70%. In the forex market, the LKR appreciated marginally against the greenback, closing at LKR 299.49/USD, compared to the previous day’s rate of 299.52/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 163.5Bn from LKR 157.3Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..