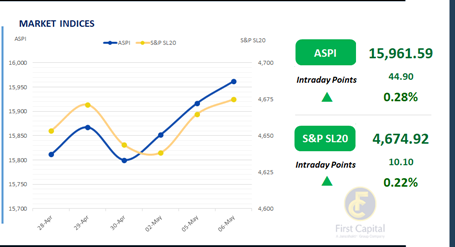

The Colombo Stock Exchange maintained its upward momentum during today’s shortened trading session, with the ASPI gaining 45 points to close at 15,962.

Market activity remained relatively stable early on, followed by a gradual ascent that led the index to finish in positive territory. Key contributors to the index were MELS, WIND, SPEN, SAMP and LION.

Investor focus was notably strong in the Food, Beverage & Tobacco and Banking sectors, which dominated market interest throughout the session.

Daily turnover stood at LKR 1.5Bn, marking a 43.8% drop compared to the monthly average of LKR 2.6Bn. The Food, Beverage & Tobacco sector led the day, contributing 35% to total turnover, while Banks and Diversified Financials jointly accounted for 24%. Foreign investors continued to exit the market, registering a net outflow of LKR 177.3Mn.

Secondary bond market slumbers, ballots take the spotlight

The secondary bond market remained largely dormant today, with trading activity tapering off significantly amid the conduct of Sri Lanka’s Local Government Elections.

As a result, the yield curve exhibited little to no movement. Among the limited transactions, the 15.12.2029 maturity traded at 10.30%, while the 15.03.2031 maturity changed hands at 10.75%.

In the midst of this subdued backdrop, CBSL announced the details of an upcoming T-Bond auction slated for 9th May-25. The auction aims to raise a total of LKR 80.0Bn, through the issuance of a 2029 maturity and a 2033 maturity.

Specifically, LKR 35.0Bn is targeted through the issuance of a bond maturing on 15.10.2029, which carries a coupon of 10.35%. In parallel, a further LKR 45.0Bn is expected to be mobilized via the 01.11.2033 maturity, offering a coupon of 9.00%.

In the foreign exchange market, the LKR depreciated marginally against the greenback, closing at LKR 299.52/USD, compared to the previous day’s rate of 299.48/USD. Meanwhile, overnight liquidity in the banking system expanded to LKR 157.3Bn from LKR 128.5Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..