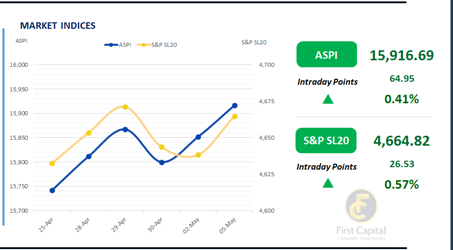

The Colombo Stock Exchange extended its upward momentum at the start of the week, with the ASPI closing at 15,917, up 65 points from the previous session.

The index opened on an upbeat note, experiencing some intraday volatility before settling in positive territory. Market momentum was driven by notable contributions from blue-chip counters and mid-cap shares including JKH, COMB, SAMP, and GLAS.

Investor sentiment appeared focused on the Capital Goods and Food, Beverage & Tobacco sectors, which drew significant attention throughout the trading day. Turnover was recorded at LKR 2.0Bn, a 27.9% decline from the monthly average of LKR 2.8Bn.

The Capital Goods sector led the turnover, accounting for 22% of total market activity, while the Food, Beverage & Tobacco and Materials sectors together contributed 34%. On the foreign front, foreign investors remained net sellers, recording a net outflow of LKR 262.5Mn.

Yield curve softens further as investors maintain buying streak

Building on the previous week's trend, investors continued to exhibit a buying sentiment, resulting in moderate trading volumes in the secondary market.

Amongst the traded maturities, 15.02.2028, 15.03.2028 and 01.05.2028 traded between the rates of 9.90% to 9.80%. Meanwhile, 15.06.2029, 15.09.2029 and 15.12.2029 traded at the rates of 10.30% to 10.20%.

Additionally, 15.03.2031 traded between the rates of 10.78% to 10.68%. Moreover, recent data published by the CBSL revealed that the AWPR for the week ending 2nd May-25 decreased by 3bps, settling at 8.36%, showcasing a notable reduction from the previous week.

In the foreign exchange market, the LKR continued its appreciation against the USD for the 4th consecutive day, closing at LKR 299.48/USD, compared to the previous day's rate of 299.58/USD.

Meanwhile, overnight liquidity in the banking system contracted to LKR 128.5Bn from LKR 168.3Bn in the previous session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..