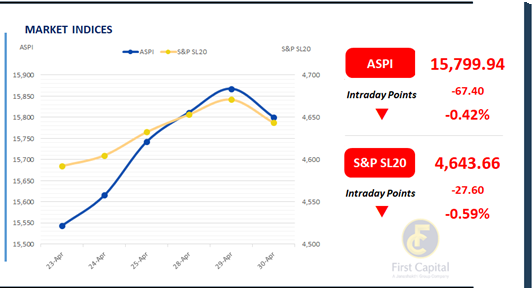

The Bourse slipped into the red, breaking the four-day positive streak, as selling pressure emerged from investors. The ASPI experienced volatility and closed with a 67-point decline at 15,800.

HNB, SAMP, CTHR, COMB and NDB emerged as the top negative contributors to the index. Investors sought after profits in today’s session, largely contributed by the HNW segment whilst retail investors expressed moderate engagement.

The Banking sector led the overall market decline, followed by Diversified Financials and Food, Beverage & Tobacco counters, as profit-taking was primarily observed in these segments.

The turnover stood at LKR 2.4Bn, reflecting a 6.7% decrease from the monthly average of LKR 2.5Bn. The Food, Beverage & Tobacco sector led today’s turnover with a 23% share, followed by the Diversified Financials and Capital Goods sectors jointly accounting for 31%. Foreign investors turned net sellers, with a net outflow of LKR 90.6Mn.

Subdued sentiment persists; yield curve remains broadly unchanged

Building on the previous day's sentiment, activity in the secondary market remained muted, resulting in low trading volumes. Consequently, the secondary market yield curve stayed largely stable.

Amongst the traded maturities, 15.02.2028, 15.03.2028, 01.05.2028 and 15.10.2028 bond maturities traded within the rates of 9.87% to 10.05%. Furthermore, the 15.09.2029 maturity traded between the rates of 10.40% to 10.35%, whilst 15.12.2029 maturity traded between 10.42% to 10.40% and finally, the 15.03.2035 maturity changed hands at 11.17%. In the forex market, the LKR showed signs of a subtle strengthening against the greenback for the 2nd consecutive day, closing at LKR 299.62/USD, compared to the previous day’s rate of 299.66/USD.

Additionally, LKR also appreciated against other major currencies such as GBP, EUR, JPY and AUD. Meanwhile, overnight liquidity in the banking system registered an uptick for the 9th consecutive day, rising to LKR 168.9Bn, from LKR 144.5Bn in the prior session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..