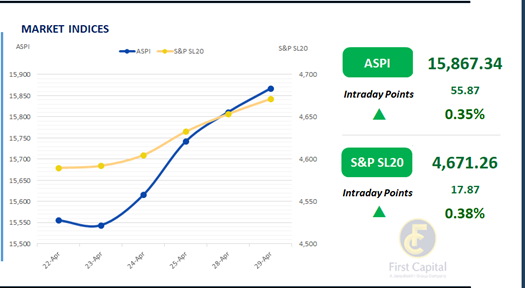

The Bourse marched onwards maintaining steady strides in the green for the fourth consecutive trading session. The ASPI wrapped up with a gain of 56 points, closing at 15,867. JKH, CTC, SPEN, COMB and HNB stood out as the top positive contributors to the index.

Strong investor interest persisted, driven by sustained activity across both HNW and retail investors. Positive sentiment was observed in Food, Beverage & Tobacco counters ahead of the earnings season, alongside improved interest in select Hotel sector counters, supported by rising tourist arrivals.

In contrast, the Banking sector experienced subdued sentiment during the session. The turnover stood at LKR 2.1Bn, reflecting an 18.1% decrease compared to the monthly average of LKR 2.5Bn.

The Food, Beverage & Tobacco sector led today’s turnover with a 19% share, followed by the Diversified Financials and Materials sectors jointly accounting for 30%. Foreign investors turned net buyers, with a net inflow of LKR 25.5Mn.

Yields edge down amid tepid volumes

CBSL conducted its weekly T-Bill auction today, raising LKR 145.0Bn in line with the initial offering. Of this, LKR 11.4Bn was raised via 3M T-Bills, while 6M and 12M T-Bills secured LKR 70.0Bn and LKR 63.6Bn, respectively.

The weighted average yield for the 3M maturity rose by 3bps to 7.65%, while the 12M T-Bill saw a marginal 1bps increase to 8.30%. Meanwhile, the 6M T-Bill dipped by 1bps to 7.97%.

Activity in the secondary market remained subdued, with thin trading volumes observed amid a notable undercurrent of buying interest. This prompted a slight downward adjustment in the yield curve.

Consequently, the 15.03.2028 maturity traded at 9.90% while the 15.10.2028 and 15.12.2028 maturities both traded at 10.00%. Further along the curve, the 15.06.2029 maturity traded at 10.30%, followed by the 15.12.2029 maturity which traded higher at 10.40%.

Finally, the 15.05.2030 maturity traded at 10.45% and the 15.03.2031 maturity changed hands at 10.90%. In the forex market, the LKR showed signs of a subtle strengthening against the greenback, closing at LKR 299.66/USD, compared to the previous day’s rate of 299.70/USD.

Meanwhile, overnight liquidity in the banking system registered a feeble uptick, rising to LKR 145.5Bn, from LKR 144.0Bn in the prior session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..