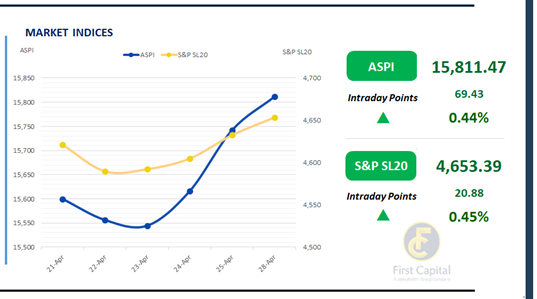

The Colombo Bourse extended its bullish momentum, with strong investor participation driving the ASPI to close in positive territory. The index surged at the open and, despite some volatility, maintained steady gains throughout the session to close at 15,811, recording an increase of 69 points.

JKH, CTHR, DIAL, HHL and HASU stood out as the top positive contributors to the index. Investors picked up where they left off at the end of the previous week as both retail and HNW segments engaged in an active trading session.

Positive sentiment was observed towards Diversified Financials and blue-chip counters, while selected Banking sector stocks also contributed positively to turnover.

Renewed investor participation supported turnover growth, which stood at LKR 2.8Bn, reflecting a 13.2% increase compared to the monthly average of LKR 2. 5Bn.

The Capital Goods sector led today’s turnover with a 29% share, followed by the Diversified Financials, and Food, Beverage & Tobacco sectors jointly accounting for 28%. Foreign investors remained net sellers, with a net outflow of LKR 101.4Mn.

CBSL T-Bond auction concludes with 3.0x oversubscription

Today, CBSL conducted a T-bond auction worth LKR 155.0Bn, raising a total of LKR 60.0Bn through the 15.06.2029 maturity, which recorded a weighted average yield of 10.30%.

Additionally, LKR 55.0Bn and LKR 40.0Bn were raised through the 15.03.2031 and 15.03.2035 maturities, respectively, at weighted average yields of 10.96% and 11.22%.

The auction was fully subscribed, signaling an improved investor confidence. Following the auction, the secondary market saw moderate trading volumes with limited activity. The 15.06.2029, 15.09.2029, and 15.12.2029 maturities traded within a range of 10.30% to 10.45%.

Notably, the 15.09.2027 maturity attracted foreign buying interest, with trades occurring between 9.60% and 9.50%. Moreover, recent data published by the CBSL revealed that the AWPR for the week ending 25th Apr-25 decreased by 5bps, settling at 8.39%, showcasing a notable reduction from the previous week.

In the forex market, the LKR strengthened against the greenback, closing at LKR 299.7/USD, compared to the previous day’s rate of 300.1/USD. Meanwhile, overnight liquidity in the banking system increased to LKR 144.0Bn, up from LKR 120.8Bn in the prior session.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..