The Colombo Bourse extended its bullish momentum, lifted by a global market rebound and renewed investor participation following clearer signals on a potential Sri Lanka–US bilateral trade agreement.

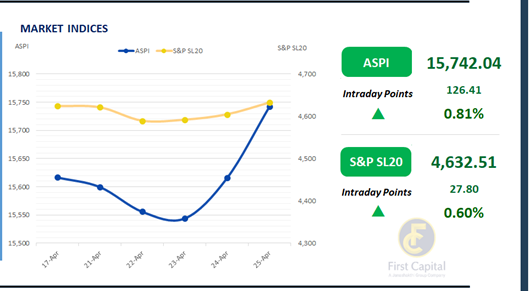

The ASPI maintained a steady upward trajectory and closed in the green at 15,742, marking a gain of 126 points. LOLC, RCL, NDB, SUN and MELS emerged as the top positive contributors to the index.

Investor sentiment and confidence strengthened as both retail and HNW segments engaged in an active trading session, reflected by a high volume of trades and increased crossings after over a week.

The turnover stood at LKR 2.4Bn, marking a 1.4% decrease from the monthly average of LKR 2.5Bn. The Capital Goods sector led today’s turnover with a 31% share, followed by the Food, Beverage & Tobacco sector at 26% and the Diversified Financials sector at 11%. Foreign investors turned net sellers, with a net outflow of LKR 103.6Mn.

Buying momentum continues bringing down belly-end yields

The secondary market continued to witness buying momentum for the 3rd consecutive day bringing down yields across mid and longer tenures.Activity also stepped up compared to the previous week following the part acceptance of the treasury bill auctions during the previous 2 weeks.

Meanwhile, moderate volumes continued to be observed on the market with activity centered largely on the mid and belly end of the curve.

With that, trades took place on the 15.03.2028, 01.05.2028, 01.07.2028, 01.09.2028 and 15.102.028 maturities between 9.95%-10.10% whilst 15.09.2029 and 15.12.2029 maturities traded at 10.40% and 10.50%, respectively.

Meanwhile, after bottoming out at LKR 56.9Bn on April 16th 2025, overnight liquidity has steadily improved, reaching LKR 120.8Bn as of April 25th 2025.In the forex market, the LKR appears to have marginally weakened against the greenback, closing at LKR 300.1/USD, compared to the previous day’s rate of 299.8/USD.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..