The bourse experienced a day of positive sentiment and increased momentum, contrasting with the volatile sentiment experienced during the day.

During today’s trading session, most of the investor attention was focused on Banking sector and Blue-chip stocks. Additionally, some selected Construction sector stocks attracted buying interest, specifically, ACL, JAT, LALU, AEL and ALUM.

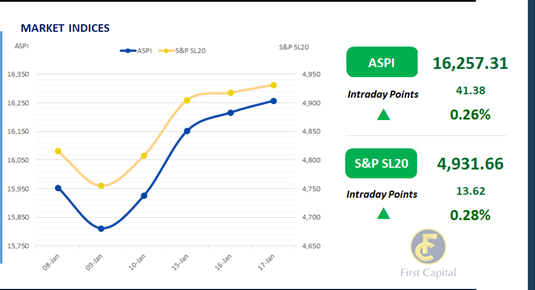

Amidst the increased participation from retail and HNW investors, ASPI closed in green at 16,257, gaining 41 points and marking a 0.26% increase from the previous day.

The most significant contributors to the positive index were DIAL, DFCC, DIPD, HHL, and COMB. Meanwhile, turnover stood at LKR 5.4Bn marking a 25.1% decrease from the monthly average, where the Banking sector led turnover at 30%, followed by Capital Goods and Materials jointly contributing 33% of overall turnover. There was a net foreign outflow of LKR 221.5Mn.

Investor interest spans across short to mid end maturities

The secondary market yield curve saw buying interest, with mixed trading activity. Investor focus was primarily on maturities in 2026, 2027, 2028, and 2030.

At the short end, there was notable buying interest, with the 1Yr bond trading at 8.65%. Bonds maturing on 15.05.26, 01.06.26, and 01.08.26 traded in the range of 9.00% to 8.95% and 15.12.26 bond traded at 9.20%.

Meanwhile, 15.01.27 maturity, traded at 9.30%. The 2028 maturities saw mixed activity, with the 15.01.28 bond trading at 10.18% and the 15.03.28 bond trading within a range of 10.18% to 10.15%. The 01.05.28 and 01.07.28 bonds traded between 10.30% and 10.35%, while the 15.05.30 bond traded at 11.15%.

Meanwhile, on the external front the LKR further depreciated against the USD closing at LKR 296.5/USD compared to LKR 295.2/USD recorded the previous day. CBSL holdings of government securities remained unchanged, closing at LKR 2,511.92Bn today. Overnight liquidity in the banking system expanded to LKR 126.30Bn from LKR 131.47Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..