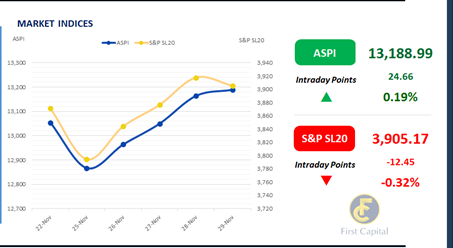

Colombo bourse experienced a day of increased volatility as mixed sentiment dominated the market. Amidst the decreased participation from retail and high net worth investors, ASPI closed in the green at 13,189, gaining 25 points, marking a 0.19% increase from the previous day.

Meanwhile S&P SL20 dipped by 0.32% compared to the previous session due to reduced activity of Conglomerates and major Banks. The most significant contributors towards the positive index were AHUN, LLUB, SPEN, SAMP, and BIL.

Additionally, specific stocks in the Hotel and Banking sector continued to attract investor interest throughout the day. Meanwhile, amidst several crossings, turnover stood at LKR 3.7Bn, marking a 3.3% decrease from the monthly average turnover of LKR 3.8Bn.

Moreover, the Consumer Services sector led the turnover by 24%, followed by the Banking and Capital Goods sectors jointly contributing 35% of the overall turnover. There was a net foreign outflow of LKR 381.9Mn signaling interest in external investments.

Dull sentiment emerges following the bond auction

After several consecutive sessions of bullish market activity, the bond market participants opted to maintain a dull sentiment through the day following the LKR 205.0Bn worth bond auction yesterday, as the secondary market witnessed thin trading volumes with limited market activity.

As a result, the secondary market yield curve remained unchanged, compared to the previous session. However, selected maturities in the short to mid tenors, specifically 01.05.27, 01.07.28, 15.10.28 and 01.12.31, attracted investor interest, trading at 10.20%, 10.53%, 10.54%, and 11.31%, respectively.

Meanwhile, on the external front, the LKR appreciated against the USD, closing at LKR 290.92/USD, compared to LKR 291.09/USD recorded the previous day. However, LKR continued to depreciate against the other major currencies such as GBP, EUR, JPY, CNY and AUD as well.

Furthermore, overnight liquidity in the banking system increased to LKR 186.91Bn from LKR 169.56Bn recorded the previous day whilst CBSL holdings of government securities remained stable at LKR 2,515.62Bn for the day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..