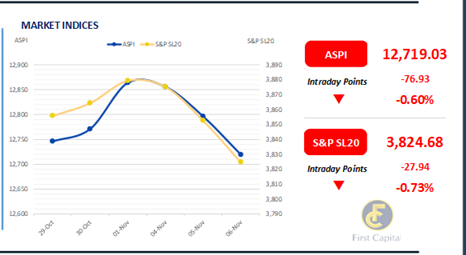

The investors in the Colombo Bourse continued the profit taking from the previous trading session, causing ASPI to lose 77 points and close the day at 12,719.

The Banking sector counters witnessed mixed activity during today’s trading session while on the flip side increased participation from HNW and institutional investors was noted.

Additionally, COMB, MELS, DFCC, RICH and NDB emerged as the top negative contributors to the index. Meanwhile, amidst the improved participation from investors, turnover experienced a 33.9% increase from yesterday and stood at LKR 3.2Bn, marking a 13.5% increase monthly average standing at LKR 2.8Bn.

Moreover, the Capital Goods sector led the turnover by 46%, followed by the Banking and Materials sectors jointly contributing 33% of the overall turnover. Foreign investors remained net buyers with a strong buying interest in JKH, recording a net inflow of LKR 199.8Mn.

Auction yields ride high again

The secondary bond market displayed a mild buying interest on mid-tenors during the day amidst limited activities and low trading volumes.

Consequently, 2027 maturities, including 01.05.27, 15.09.27, and 15.12.27, traded within a range of 11.50%-11.25%. Meanwhile, 2028 maturities, including those dated 15.02.28, 15.03.28, 15.10.28, and 15.12.28, saw trades within the range of 11.90%-11.67%.

Furthermore, at the first weekly T-bill auction of the month, held today, the CBSL fully subscribed to the total offered amount of LKR 175.0Bn, with auction yields increasing across the board for the second consecutive auction.

The 3M maturity was oversubscribed with CBSL accepting LKR 92.4Bn (exceeding the total offered of LKR 60.0Bn) at a WAYR of 9.37%, whilst both the 6M and 1Yr maturities were undersubscribed.

Accordingly, CBSL accepted LKR 58.8Bn for the 6M maturity at a WAYR of 9.70% and LKR 23.9Bn for the 1Yr bill at a WAYR of 9.95%. Notably, the overnight liquidity for the day increased to LKR 152.6Bn, whilst CBSL holdings remained stagnant at LKR 2,515.6Bn.

Furthermore, in the forex market, the LKR marginally depreciated against the USD, closing at LKR 293.1, whilst it appreciated against most of the major currencies including GBP, EUR, JPY, CNY, and AUD for the day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..