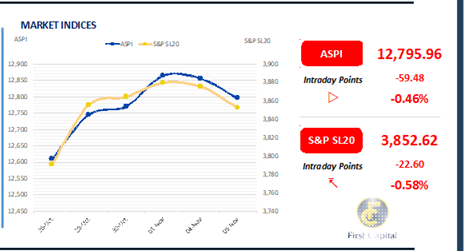

Investors booked profit during today’s trading session, resulting in a dip in the ASPI during the initial trading hours. However, the index saw a slight recovery in the post midday, to close the day at 12,796, losing 59 points.

The Banking sector and blue-chip stocks experienced a slightly negative sentiment compared to the previous sessions where MELS, HNB, LOLC, HHL, and COMB emerged as the top negative contributors to the index.

Meanwhile, amidst the improved participation from HNW investors, turnover experienced a 28.0% increase from yesterday and stood at LKR 2.4Bn, marking a 15.9% decrease monthly average standing at LKR 2.8Bn.

Moreover, Banking sector led the turnover by 60%, followed by the Food, Beverage & Tobacco and Capital Goods sectors jointly contributing 19% of the overall turnover. Foreign investors turned net buyers, with a net inflow of LKR 15.8Mn.

Bonds witnessed a slight bullishness on the short to mid end

The secondary bond market yield curve saw a slight decline on the short to mid-end, driven by renewed buying interest following a period of subdued market activity.

On the short end, investor demand was evident on 15.12.26 bond which traded at 10.60%, while 01.05.27 bond changed hands between 11.41%-11.37%.

The 15.09.27 and 15.12.27 bonds both saw trades at 11.45%. In the mid-end, the 15.02.28 and 15.03.28 bonds traded at 11.70%, with the 15.12.28 bond changing hands at 11.95%. At the long end, the 15.05.30 bond also traded at 12.20%. Overall, the market experienced thin volumes across the curve.

Meanwhile, CBSL announced an issue of LKR 175.0Bn T-bills through an auction to be held tomorrow. On the external side, the LKR slightly depreciated against the greenback, closing at LKR 293.1.

On the other hand, LKR broadly appreciated against most of the major currencies, notably GBP, EUR, JPY and AUD. Meanwhile, overnight liquidity recorded at LKR 98.4Bn while CBSL Holdings remained unchanged at LKR 2,515.6Bn

First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..