After a week of bullish momentum, ASPI experienced a slight downturn at the beginning of the week, influenced by mixed sentiment of investors that led to selling pressure in the latter part of the trading session.

Furthermore, selected Banking sector stocks and blue-chip shares experienced active trading throughout the day, while the recently released 2QFY25 quarterly results of PARQ also boosted investor sentiment.

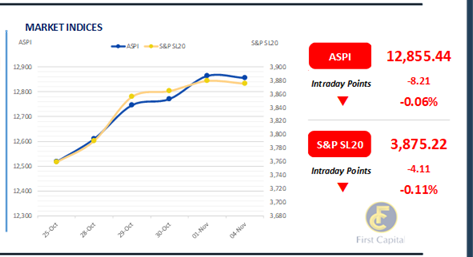

Additionally, Tourism sector stocks such as CONN and JETS saw increased buying interest following their strong quarterly results. Accordingly, the ASPI closed the day at 12,855, losing only 8 points.

Meanwhile, amidst the decreased participation from both retail and HNW investors compared to the previous week, turnover stood at LKR 1.9Bn, marking a 33.2% decrease monthly average standing at LKR 2.8Bn.

Moreover, Banking sector led the turnover by 34%, followed by the Food, Beverage & Tobacco and Capital Goods sectors jointly contributing 34% of the overall turnover. Foreign investors turned net sellers, with a net outflow of LKR 31.4Mn

Secondary bond market on a standstill

The secondary bond market witnessed a dreary session during the day as the market experienced a standstill on the back of very thin volumes.

The broader market adopted a stagnant approach longing for further clarity on the market sentiment. Towards the mid end of the curve 01.05.27 tenor traded at 11.50%.

AWPR decreased by 12bps recording at 9.05% for the week ending 01st Nov 2024, whilst AWDR stood at 7.61% for Oct 2024. On the external side, the LKR appreciated against the USD recording at LKR 292.98 compared to LKR 293.41 recorded during the previous session.

Furthermore, LKR also appreciated against EUR and CNY despite the depreciation against GBP, AUD and JPY. Overnight liquidity was recorded at LKR 140.05Bn increasing from LKR 140.05 recorded during the previous session. Moreover CBSL holdings remained stagnant at LKR 2,515.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..