The Colombo Bourse sustained the bullish momentum for the second consecutive session as HNW and institutional investors maintained a positive sentiment on Banking sector counters and conglomerates.

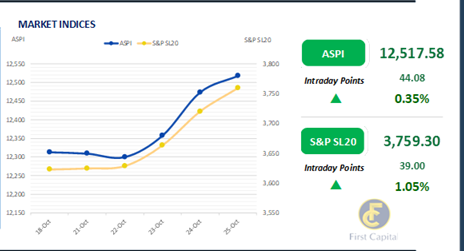

The ASPI closed the week at 12,518 gaining 44 points led by JKH, COMB, LOLC, DFCC and CTC, which emerged as the top positive contributors to the index.

Amidst the improved participation from HNW and institutional investors, turnover stood at LKR 4.8Bn for the second consecutive day, marking a 95.1% increase from the monthly average standing at LKR 2.4Bn.

Moreover, off-board transactions contributed 44.9% to the overall turnover. Meanwhile, the Banking sector led turnover by 58%, followed by the Capital Goods and Material Sectors jointly contributing 24% of the overall turnover.

Foreign investors remained net sellers, with a net outflow of LKR 186.4Mn whilst total foreign outflow for the week stood at LKR 179.6Mn.

Thin volumes ahead of bond auction

The secondary bond market yield curve remained broadly unchanged, with thin trading volumes and subdued activity as investors opted for a wait-and-see stance ahead of the upcoming Bond Auction scheduled for the 28th of Oct-24, which will offer LKR 32.5Bn in T-Bonds.

There was some selling interest observed on the short to mid end of the curve. Amongst the traded maturities, notable trades were among the 2027, and 2028 maturities.

On the short end of the curve, 15.09.27, and 15.12.27 were seen trading at a rate of 11.50%. On the belly end of the curve, 01.05.28 traded at a rate of 11.85%. Additionally, 15.06.29 traded between rates of 12.05% - 12.08%, and 15.10.30 traded between rates of 12.35% – 12.25%.

Meanwhile, on the external front, the LKR depreciated against the USD, closing at LKR 293.7/USD, compared to LKR 293.3/USD recorded the previous day.

Similarly, the LKR depreciated against other major currencies including the GBP, EUR, AUD, and JPY. CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today.

Overnight liquidity in the banking system expanded to LKR 156.27Bn from LKR 153.57Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..