The Colombo Bourse experienced sustained bullish momentum following several volatile trading sessions, as positive sentiment was maintained on Banking sector counters and Blue-chip stocks during today’s trading.

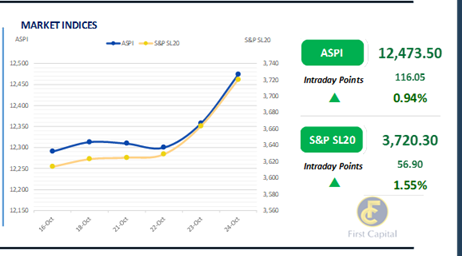

The index reached an over 5-month high and closed the day at 12,474 gaining 116 points. JKH, SAMP, HNB, CTC and HAYL emerged as the top positive contributors to the index.

Amidst the improved participation from retail and HNW investors, turnover reached an over 8-month high and stood at LKR 4.8Bn, marking an over 100% increase from the monthly average standing at LKR 2.3Bn.

Meanwhile, the Capital Goods Sector led turnover by 38%, followed by the Banking and Diversified Financials Sectors jointly contributing 36% of overall turnover. Foreign investors turned net sellers, with a net outflow of LKR 39.8Mn.

Mixed interest drives the secondary bond market

The secondary bond market displayed a mixed sentiment throughout the day on the back of low volumes continuing the trend from the previous sessions.

Selling interest centered around mid-tenors whilst long tenors experienced buying interest. Accordingly, towards the belly end of the curve, liquid tenors recorded trades namely, 15.09.27 maturity traded between the range of 11.43%-11.50%.

15.03.28, 01.05.28, 01.07.28, 15.12.28 traded between the range of 11.72%-11.95%. 15.06.29, 15.09.29 tenors traded at 12.05%. Towards the long end of the curve, 15.05.30 traded between 12.20%-12.25% whilst 01.12.31 tenor traded between the range of 12.35%-12.32%. on the external side LKR remained stagnant against the USD recording at LKR 293.3 during the day.

However, LKR appreciated against most of the major currencies during the day namely GBP, EUR, JPY and AUD. Overnight liquidity increased to LKR 153.6 whilst CBSL holdings remained stagnant at LKR 2,515.6.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..