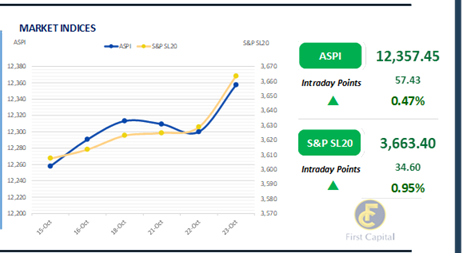

The Broad Market experienced mixed sentiments during the trading session; however, increased buying interest in Banks, Blue-chips, and selected NBFI counters drove the ASPI to close the day in green at 12,357, gaining 57 points. JKH, COMB, SAMP, NDB and CFIN emerged as the top positive contributors to the index.

Meanwhile, amidst the improved participation from HNW investors, turnover stood at LKR 2.3Bn, marking a 2.6% increase from the monthly average, where off-board transactions contributed 17.0% of the overall turnover.

The Banking sector led the turnover at 35%, followed by the Capital Goods and Food, Beverage & Tobacco sectors jointly contributing 41% of the overall turnover. Foreign investors remained net buyers, with a net inflow of LKR 118.1Mn.

T-Bill auction yields remain stable

The secondary market yield curve remained broadly unchanged during the day, reflecting mixed sentiment while generating moderate trading volumes.

In the short end of the curve, 15.09.27 and 15.12.27 maturities were traded in the range of 11.35%-11.45%. On the mid end, 15.02.28, 15.03.28 and 01.07.28 saw trades between 11.70%-11.85%.

Meanwhile, on the long end, 15.05.30 maturity was observed trading between 12.15%-12.20%, respectively. In the primary market, following four consecutive declines in yields, stability was noted across the board during today’s T-Bill auction. The total offered T-Bill amount of LKR 125.0Bn was fully accepted, with 53% being accepted from the 03M T-Bill.

Moreover, the weighted average yields of 03M, 06M, and 01Yr T-Bills remained stable at 9.32%, 9.65% and 9.95%, respectively. Meanwhile, CBSL announced the issuance of LKR 32.5Bn worth of T-Bonds through an auction scheduled for 28th Oct 2024.

This issuance includes LKR 20.0Bn and LKR 12.5Bn to be issued under the maturities of 15.10.28 and 01.06.33, respectively. On the external side, the LKR depreciated against the greenback closing at LKR 293.3. Meanwhile, the overnight liquidity was recorded at LKR 144.1Bn while CBSL Holdings remained unchanged at LKR 2,515.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..