At the week closing, the Broad Market experienced another volatile trading day as investors maintained mixed sentiment throughout the session.

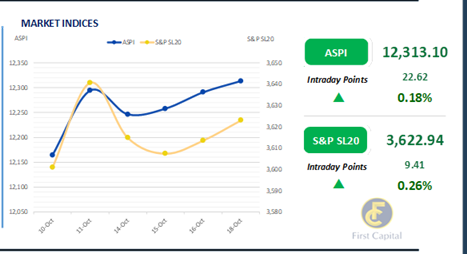

However, the index managed to close the week in green at 12,313, gaining 23 points. Investors continued the positive sentiment on the selected Plantation sector stocks such as BALA and AGPL.

Notably, LFIN experienced increased buying interest during the session following the announcement of its 2QFY25 results on 16th Oct-24.

Amidst the improved participation from retail investors, turnover experienced a slight increase from yesterday and stood at LKR 2.0Bn. However, this marks a 10.3% decrease from the monthly average standing at LKR 2.2Bn.

The Diversified Financials sector led turnover at 33%, followed by Food, Beverage & Tobacco and Capital Goods sectors jointly contributing 29% of overall turnover. Foreign investors remained net sellers, with a net outflow of LKR 87.3Mn.

Bond yields tick higher on extended selling

Concluding the week, the secondary market yield curve slightly edged up across the board amidst slight selling interest while the overall market witnessed low volumes and limited activities.

In the midst of slight selling interest, 15.12.2027 maturity changed hands in the range of 11.30%-11.35%. Additionally, tenors maturing in 2028, such as 15.02.2028, 15.03.2028, 01.05.2028, and 01.07.2028, changed hands at yields ranging between 11.65%-11.80%.

The selling interest extended to the longer end of the curve as well, with the 15.05.2030 maturity trading at a yield of 12.15%.

Furthermore, the CBSL has announced a Treasury Bill issuance totaling LKR 125.0Bn through an auction scheduled for 23rd Oct 2024, out of the total auction, LKR 40.0Bn is to be raised from 91-day maturity, LKR 42.5Bn is expected to be raised from 182-day maturity while LKR 42.5Bn is to be raised from 364-day maturity.

On the external side, the LKR appreciated against the greenback closing at LKR 293.0. Meanwhile, overnight liquidity recorded at LKR 139.10Bn while CBSL Holdings remained unchanged at LKR 2,515.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..