After a few sessions of profit taking Colombo Bourse witnessed sustained buying interest throughout the trading day amidst the improved participation from both retail and HNW investors.

ASPI started the day on a bullish note, continuing its positive trend from previous day's close. Selected Banking and Diversified Financial sector counters along with blue-chip stocks took the center stage while renewed interest on Plantation sector stocks was observed mainly in KAHA, HAPU, UDPL and MASK.

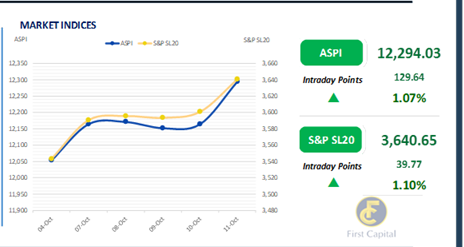

Accordingly, ASPI closed the trading session in green at 12,294 gaining 130 points. Meanwhile, turnover saw a 44.6% increase from yesterday and stood at LKR 2.3Bn, marking a 12.8% increase from the monthly average standing at LKR 2.0Bn.

Furthermore, 24% of the overall turnover was contributed by the Banking sector whilst 39% of the turnover was jointly contributed by the Capital Goods and Food, Beverage & Tobacco sectors. Notably, foreign investors remained net buyers for the third consecutive session with a net foreign inflow of LKR 107.2Mn on the back of strong foreign buying interest on JKH with a foreign inflow of LKR 63.5Mn.

Yield curve edges down amidst post-auction buying

At today’s LKR 95.0Bn worth bond auction, the total offered was fully accepted from each maturity with 15.03.2028 bond closing at a weighted average yield rate of 11.79% amidst higher reception.

Meanwhile, 01.10.2032 bond closed at 12.36% at the end of today’s auction. Post auction, strong bullish interest emerged in the secondary market resulting in a downward shift in the yield curve.

Mid tenors attracted larger interest during the day resulting in a 10-15bps decline in yields. Accordingly, on the liquid tenors, 15.12.2027 closed trades at 11.30% while15.02.2028 and today’s auction bond; 15.03.2028 closed deals at 11.55%. 01.05.2028 and 01.07.2028 registered transactions at 11.65% level.

Moreover, 15.12.2028 recorded transactions at 11.75% and 15.09.2029 recorded transactions at 11.85% at the end of the trading day. On the external side, rupee exhibited a mixed trend against major currencies. Accordingly, LKR slightly depreciated against the USD and AUD compared to the previous day, closing at LKR 293.1/USD and LKR 197.6/AUD, respectively.

However, the rupee registered an appreciation against other currencies namely, GBP and EUR. Meanwhile, at the end of the day, overnight liquidity closed at LKR 141.83Bn while CBSL Holdings remained steady at LKR 2,515.62Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..