The Colombo Bourse experienced a downturn during the trading session as investors booked profits, leading to mixed sentiment among investors.

The ASPI started the day on a bullish note; and, however, selling pressure emerged after the first thirty minutes of trading, particularly in the Banking sector and blue-chip stocks.

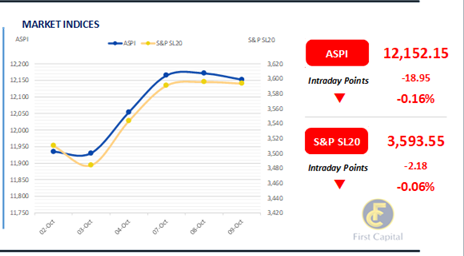

Even though the market recovered instantly over 35 points in the last 15 minutes, the index failed to sustain the positive momentum of the previous 3 trading sessions as the market turned red, reaching 12,152, losing 19 points.

The Banking sector counters SAMP and DFCC coupled with blue-chip and finance stocks namely, HAYL, LOLC and SPEN contributed negatively to the index.

On a positive note, AGPL witnessed a 9.8% price upside following its dividend announcement today. Notably, the market witnessed strong activity on JKH backed by healthy foreign participation amidst improving investor confidence arising from the potential completion of the external debt restructuring.

Led by JKH, the market recorded a net foreign inflow of LKR 339.1Mn. Turnover witnessed a significant upturn from the previous day and stood at LKR 2.1Bn on the back of three off-board transactions despite the lower retail participation compared to previous sessions

.

This marked a 6.0% increase from the monthly average standing at LKR 2.0Bn. Furthermore, 29% of the overall turnover was contributed by the Capital Goods sector whilst 37% of the turnover was jointly contributed by the Diversified Financials and Banking sectors.

T-Bill auction rates experience notable declines

At the T-Bill auction held today, the CBSL fully accepted the bills offered totaling LKR 85.0Bn. The CBSL fully subscribed to all three bills, where the 3M T-bill was fully accepted at LKR 40.0Bn, the 6M T-bill was accepted at the offered amount of LKR 35.0Bn, and the 1Yr T-bill was fully accepted at LKR 10.0Bn.

The weighted average yield rates saw significant declines, where the 3M bill saw a decline of 37bps at 9.69%. The 6M bill also saw a decline of 42bps at a rate of 9.95%. The 1Yr bill saw a slight decline of 4bps at a rate of 10.00%.

Meanwhile, the secondary market yield curve faced some selling pressure ahead of the bond auction to be held on 11th Oct-24, and the market experienced slight buying interest following the T-Bill auction results.

Notable trades were on the short to mid end of the curve, primarily amongst the 2027 and 2028 maturities. On the short end of the curve, 01.05.27, and 15.09.27 traded at rates of 11.30% and 11.40%, respectively.

On the belly end of the curve, 15.02.28, 15.03.28, 01.05.28, and 15.12.28, traded at rates of 11.90% - 11.77%, 11.90%, 11.90% - 11.80%, and 12.00%, respectively.

Additionally, 15.09.29, was seen trading between rates of 12.05% - 12.00%. Following the results of the T-Bill auction, the 6M bill traded at a rate of 9.55%. On the external front, the LKR appreciated against the USD, closing at LKR 293.36/USD compared to LKR 293.55/USD recorded the previous day.

CBSL holdings of government securities remained unchanged, closing at LKR 2,515.62Bn today. Overnight liquidity in the banking system expanded to LKR 132.21Bn from LKR 75.23Bn recorded the previous day.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..