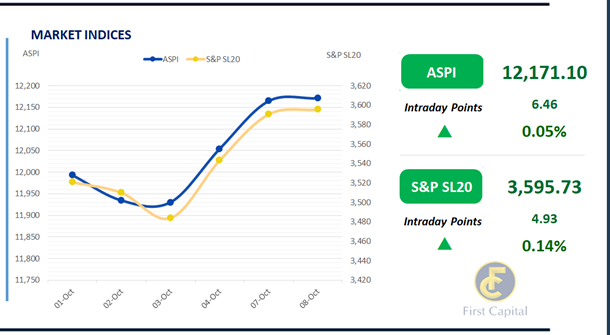

Colombo bourse witnessed a mixed trading session with significant volatility throughout the day and finally ending up by 6 points at 12,171.

After a spike in the initial few minutes Bourse registered selling pressure within the 1st hour of trading amidst profit taking primarily in the Banking sector counters.

However, towards mid-day Bourse recovered with bargain hunters taking centre stage, but failed to sustain the momentum towards the end of the day.

Capital Goods sector led by bluechip heavy weights JKH, HAYL, SPEN led the positive contributors to the index while banking and finance counters HNB, SAMP, LOLC led the negatives list.

Turnover recorded a notable dip amidst the slower volumes resulting from lower retail participation stemming from the selling pressure witnessed during the day as it was recorded at LKR 1.4Bn, 29.3% lower than the monthly average of LKR 2.0Bn.

Furthermore, 26% of the overall turnover was contributed by the Capital Goods sector whilst 24% of the turnover was contributed by the Banking sector.

Yield curve edges higher ahead of the T-bill and T-bond auction

The secondary bond market yield curve edged higher across the board, driven by thin trading volumes and profit-taking activity as investors adopted a wait-and-see approach ahead of the upcoming T-bill and T-bond auctions.

After the morning session, the yield curve saw a slight uptick as investors continued to lock in profits from the previous day. Meanwhile, CBSL is expecting raise LKR 85.0Bn from three maturities through a T-bill auction which is scheduled for tomorrow.

Additionally, CBSL announced LKR 95.0Bn worth T-bond auction today which will be held on 11th Oct 24, expecting to raise LKR 70.0Bn and LKR 25.0Bn through two maturities.

Among the traded maturities, short tenor 15.12.27 traded at 11.55% while towards the belly end of the curve, 15.02.28 traded between 11.70% -11.80%, 01.05.28 traded between 11.80% -11.85% and 01.07.28, 15.12.28 and 15.09.29 traded at 11.85%, 11.90% and 12.12% respectively.

On the external front LKR slightly depreciated against the green back recording at LKR 293.55 compared to the previous day which was recorded at LKR 293.78. Notably, the overnight liquidity for the day significantly declined to LKR 75.23Bn compared to the previous day, whilst CBSL holdings of government securities remained stagnant at LKR 2,515.6Bn for the 15th consecutive session

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..