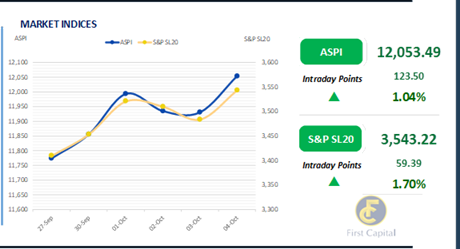

The broader market regained momentum during the day pivoting from the selling pressure witnessed during the previous sessions as it eased on the green zone.

The index reached a 3 month high, as it closed at 12,053 gaining 124 points. Banking sector and blue chip stocks mostly backed the positive momentum namely JKH, SAMP, HNB and NDB.

Turnover was recorded at LKR 2.8Bn, 56.6% higher than the monthly average of LKR 1.8Bn. HNW investors mostly attributed to the inclined revenue as 35.4% of the turnover was dominated by off board transactions whilst retail participation was commendable.

Banking sector contributed 64% of the overall turnover whilst Capital Goods and Food, Beverage and Tobacco sectors jointly contributed 18%.

Profit-taking continued, resulting in an uptick in yields

The secondary bond market yield curve saw a slight uptick on the short to mid end as market participants sought to realize gains from the recent Bull Run.

In the early hours, there was a moderate buying sentiment for the 15.05.26 and 01.06.26 bonds, which traded at 10.50%. On the mid end, the 15.12.27, 15.02.28, and 15.12.28 bonds changed hands at 11.45%, 11.55%, and 11.70%, respectively.

As the day progressed, heightened selling interest led to a rise in interest rates across these maturities. The 15.12.27 bond traded at 11.55%, while the 15.02.28, 01.05.28, 01.07.28, and 15.12.28 bonds traded in a range of 11.70% to 11.80%. Additionally, the 15.05.30 bond displayed mixed sentiment, trading at 12.10%.

Furthermore, the CBSL has announced a Treasury Bill issuance totaling LKR 85.0Bn through an auction scheduled for 9th Oct 2024, out of the total auction, LKR 40.0Bn is to be raised from 91-day maturity, LKR 35.0Bn is expected to be raised from 182-day maturity while LKR 10.0Bn is to be raised from 364-day maturity.

On the external side, the LKR slightly depreciated against the greenback closing at LKR 295.5. Meanwhile, CBSL liquidity started to build up from dollar purchases. Accordingly, overnight liquidity recorded at LKR 110.9Bn while CBSL Holdings remained unchanged at LKR 2,515.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..