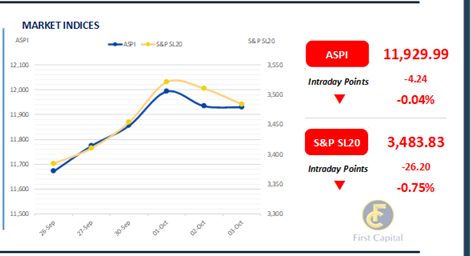

The bourse experienced another day of profit taking, as the ASPI fell to 11,930, losing 4 points and marking a 0.04% decline from the previous day.

The most significant contributors towards the negative index were HNB, SAMP, COMB, HAYL, and JKH, reflecting low participation from HNW investors. Additionally, CINS was responsible for positive contributions towards the index.

Selling sentiment dominated the market, where banks predominantly experienced increased selling pressure.

Today marked the inaugural day of trading for PickMe (PKME), with shares rising by 8.3%. Turnover saw a decline, standing at LKR 1.3Bn, marking a 41.8% decrease from the previous day, where the Banking sector led turnover by 26.8%, followed by the Diversified Financials, and Capital Goods sectors jointly contributing to 34.9% of overall turnover over.

There was a net foreign outflow of LKR 18.0Mn signaling interest in external investments.

Profit taking emerges following extended bullish momentum

The secondary market sentiment saw a reversal in sentiment during the day as investors resorted to book profits after extended bullish interest. Mid tenor maturities attracted most interest during the day. Accordingly, on the short end of the curve, 01.06.2025 saw trades at 10.40% while 01.06.2026 registered trades at 10.45%. Moreover, 15.12.2027 recorded transactions between 11.40%-11.50%. On the 2028 tenor, 15.02.2028 hovered between 11.45%-11.60% and 15.12.2028 hovered between 11.65%-11.80%. Meanwhile, 15.06.2029 registered trades between 11.90%-12.10% while 01.12.2031 recorded between 12.30%-12.38%. Overnight liquidity improved compared to previous day and closed at LKR 114.7Bn while CBSL Holdings remained stagnant at LKR 2,515.6Bn.

On the external side, LKR continued to appreciate against the greenback, closing at LKR 294.9/USD, compared to yesterday's closing of LKR 295.6/USD. Similarly, LKR appreciated against other major currencies including, GBP, EUR, CNY, JPY and AUD. Meanwhile, Weekly AWPLR for the week ending 27th Sep-24 decreased by 06bps to 9.32% compared to the previous week while AWLR as at Aug-24 remains at 12.12%, indicating a broader gap between both.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..