Investors continued the positive sentiment for the 11th consecutive day as Banking sector and Consumer Durables & Apparel sector counters contributed towards the momentum.

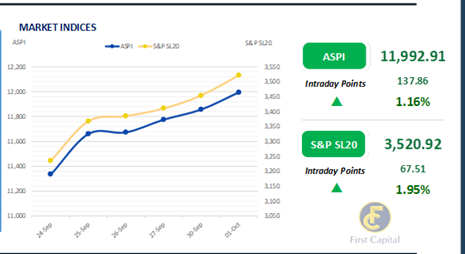

The Colombo Bourse opened the day on a negative note with dull investor sentiment. However, the index rebounded quickly and surged to an intraday high of 12,008 in the post midday.

Ultimately, the index closed the session at 11,993 gaining only 138 points. Notably, HNB and SAMP recorded 4.6% and 1.0% price increases respectively whilst, Consumer Durables & Apparel sector stocks saw renewed buying interest following the announcement that export earnings from the Apparel and Textile sector rose by 17.5%YoY, reaching USD 512.1Mn in Aug-24 compared to Aug-23.

Additionally, HNB, JKH, COMB, DFCC and SAMP emerged as the top positive contributors to the index. Meanwhile, on the back of nine off-board transactions, turnover stood at LKR 3.5Bn, marking over 100% increase from the monthly average standing at LKR 1.6Bn.

The Banking sector solely contributed 44% to the overall turnover whilst the Capital Goods and Consumer Durables sectors jointly contributed 22% to the total turnover.

Mixed sentiment lingers ahead of tomorrow’s bill auction

The secondary bondmarket exhibited mixed activities throughout the day, with subdued trading volumes ahead of tomorrow's LKR 142.5Bn T-bill auction.

In the early hours, modest selling pressure was observed on mid-tenor bonds, specifically the 2028 and 2029 maturities. The 15.02.28 maturity traded at 11.90%, while the 15.09.29 maturity traded at 12.05%.

However, in the latter part of the session, renewed buying interest surfaced, with the 15.12.27 maturity trading within a narrower yield band of 11.60%-11.55%.

The 2028 maturities, including 15.02.28 and 01.07.28, traded between 12.00%-11.82%, whilst the 2029 maturities, such as 15.06.29 and 15.09.29 ranged from 12.07%-11.95%.

Moreover, foreign holdings in government securities slightly increased by 0.01%WoW, registering at LKR 39.4Bn as of 26th September 2024. Consequently, the foreign holding percentage remained stagnant at 0.23% over the week. Notably, the overnight liquidity for the day significantly declined to LKR 7.57Bn, whilst CBSL holdings remained stagnant at LKR 2,515.6Bn for the 10th consecutive session.

Furthermore, in the forex market, the LKR continued to appreciate against the USD for the 06th consecutive session, closing at LKR 297.2 for the day. During the year up to 27th September 2024, the LKR has appreciated by 7.3% against the USD, reflecting a strong overall performance for the year.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..