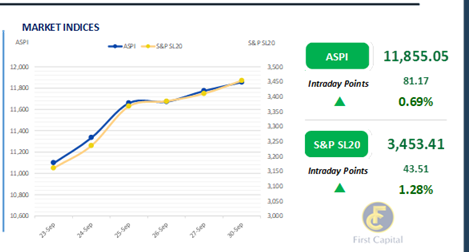

The Broad Market wrapped the day in green for the 10th consecutive day as investors opted to maintain the positive sentiment of the previous week.

The market started the day on a bullish note, with the index soaring to an intraday high of 11,914. As selling pressure emerged, the market experienced a pullback and experienced sideways movement.

However, the ASPI recovered gradually and closed the day at 11,885, gaining 81 points. Significantly, a major stake was traded in UML in the main board, making UML the second highest contributor to the overall turnover.

The majority of the hotel sector counters witnessed selling pressure during the day, particularly with notable declines in MARA and BERU. JKH, COMB, NDB, CFIN and SAMP emerged as the top positive contributors to the index.

Meanwhile, turnover stood at LKR 2.6Bn, marking an 80.3% increase from the monthly average standing at LKR 1.4Bn. The Banking sector solely contributed 26% to the overall turnover whilst the Capital Goods and Retailing sectors jointly contributed 28% to the total turnover.

Market takes a breath post bullish surge

In the bond market investor sentiment paused momentarily following a substantial buying momentum witnessed in previous days, indicating a period of stabilization ahead of the T-Bill auction.

In the secondary bond market, 3M and 6M T-Bills changed hands at 10.00% and 10.25%, with limited activities, 15.12.26 maturity traded at 10.75%. Meanwhile, mid tenors 15.02.28, 15.07.29 and 15.09.29 were seen trading at 11.95%, 12.10% and 12.05%, respectively.

Overall market volumes remained low. Furthermore, the CBSL has announced a Treasury Bill issuance totaling LKR 142.5Bn through an auction scheduled for 2nd Oct 2024, out of the total auction, LKR 65.0Bn is to be raised from 91-day maturity, LKR 67.5Bn is expected to be raised from 182-day maturity while LKR 10.0Bn is to be raised from 364-day maturity.

Meanwhile, inflation as measured by the CCPI further decelerated to -0.5% in Sep-24 from 0.5% in Aug-24 driven by lower Food and Non-Food inflation. Food inflation declined to -0.3%, while non-food inflation dropped to -0.5%.

Similarly, core inflation also slightly lowered to 3.3% in Sep-24 compared to 3.6% in Aug-24. On the external side, the LKR further appreciated against the greenback closing below LKR 300.0 mark at LKR 299.4. Meanwhile, overnight liquidity recorded at LKR 88.65Bn while CBSL Holdings remained unchanged at LKR 2,515.6Bn.

Courtesy: First Capital Research

Subscribe to our newsletter to get notification about new updates, information, etc..